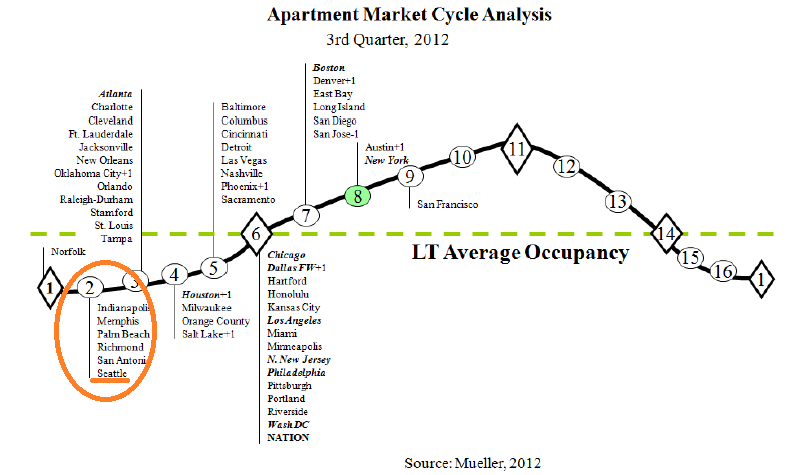

Seattle’s Strange Trip Through the Apartment Building Investment Cycle Part II

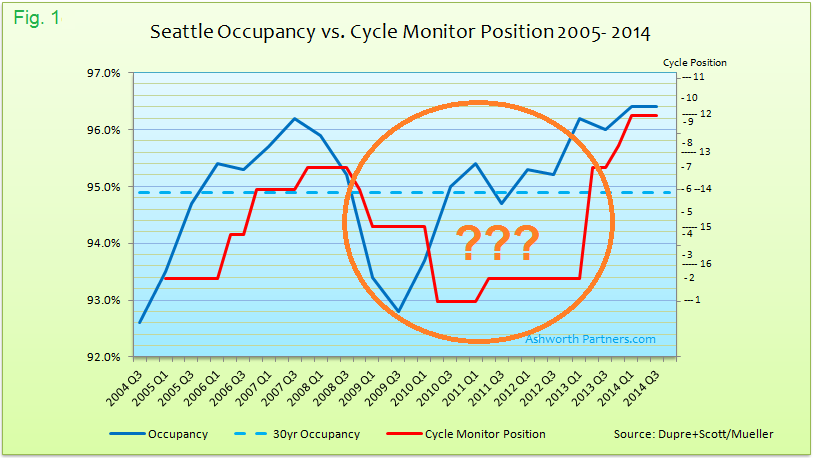

In part I we saw that some of the most widely followed market cycle research can’t be relied on without question. If knowing where we are in the market cycle is the most important thing (and not everyone agrees, see the comments from one of my private equity guys about that under part I here) then the best solution is probably to chart the cycles for the markets we’re investing in ourselves. If you’re in multiple CRE sectors in a lot of markets hopefully you have someone on your team or can hire a consultant (like Ashworth) to chart those cycles.

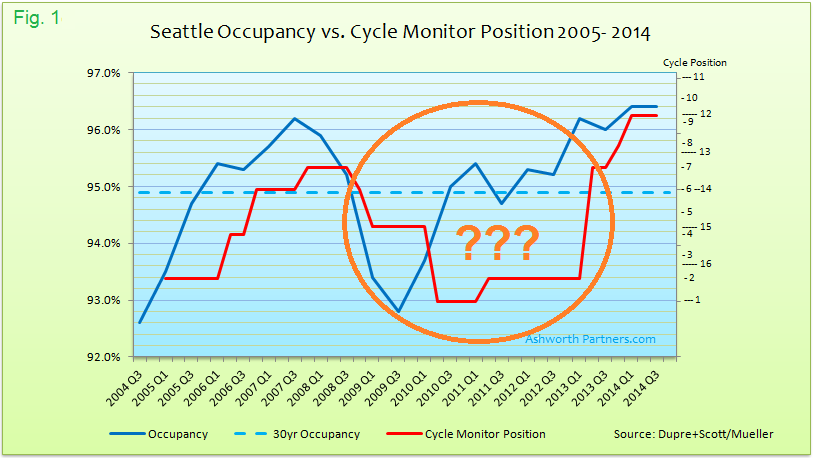

Building our own CRE market cycle chart

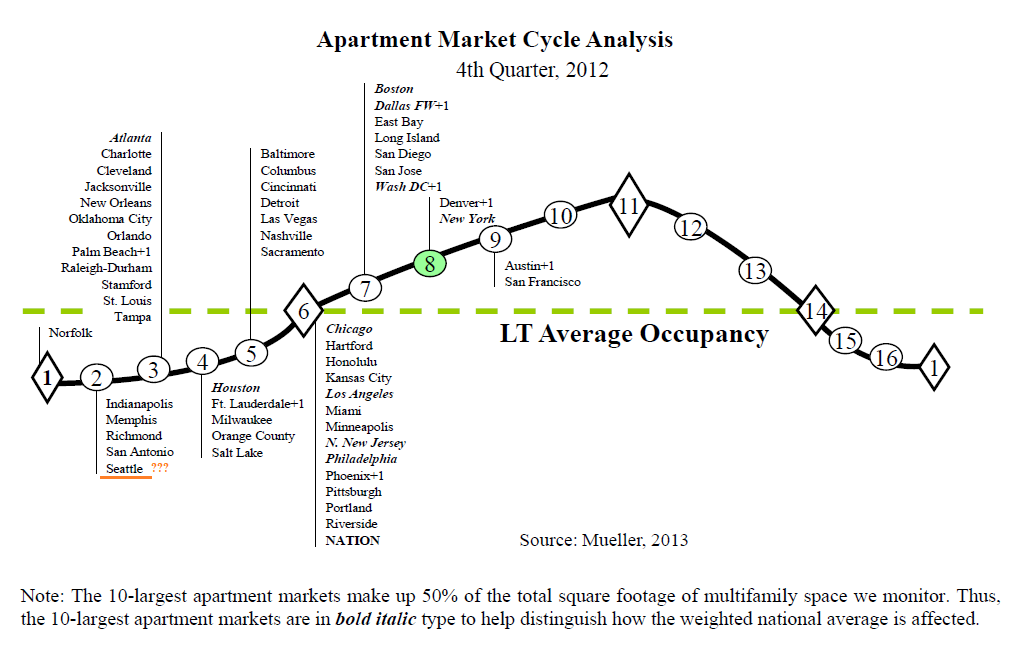

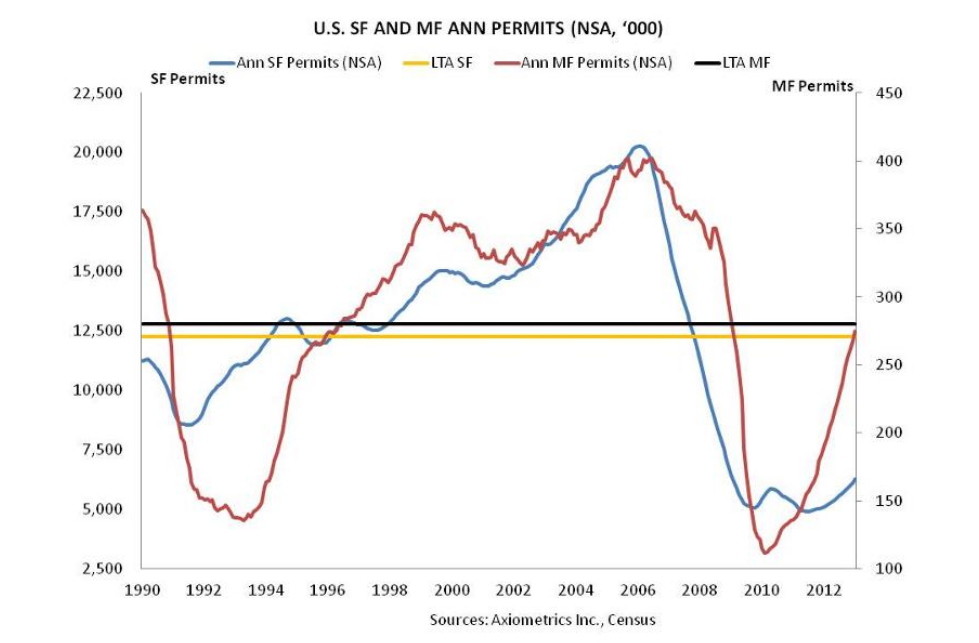

To track a cycle for one market and sector we only need to answer five questions according to Professor Mueller’s methodology: Market occupancy, the 30 year Long Term Average (LTA) occupancy, rent growth, inflation and new unit construction. Later we’ll look at whether we can Continue reading 3 Things I Learned Charting Apartment Building & Commercial Real Estate Market Cycles