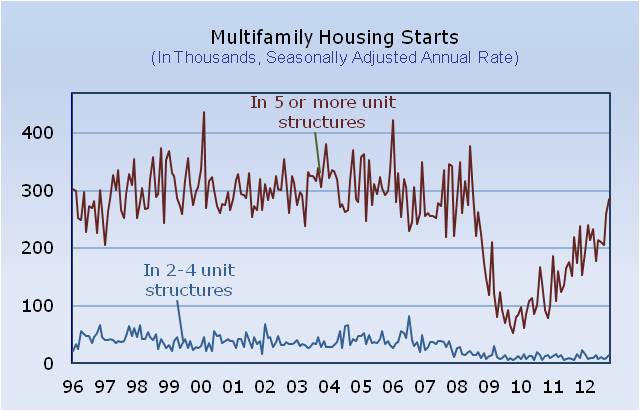

The NAHB is out this morning with a chart that gives some perspective on apartment building investment starts. The Census Bureau reported 285,000 unit starts in October for 5+ unit buildings. At that rate it looks like we’re just returning to what was a sustainable level of starts in the ’97-’06 period.

While developers tend to overshoot the sustainable level (which is where the apartment building investment cycle comes from) the hope is that Continue reading Some perspective on New Apartment Building Unit Starts: Census Bureau’s stats charted by the NAHB