Apartment building investment loans in 2014, thoughts and predictions on what’s in store from lenders large and small and the organizations who represent them:

Greystone via MultiHousingNews: We do think there will be more capital available,” says Bob Barolak, co-COO at Greystone. Lenders will become even more eager to make loans in the multifamily space, he says, because of greater confidence in the economy and markets.

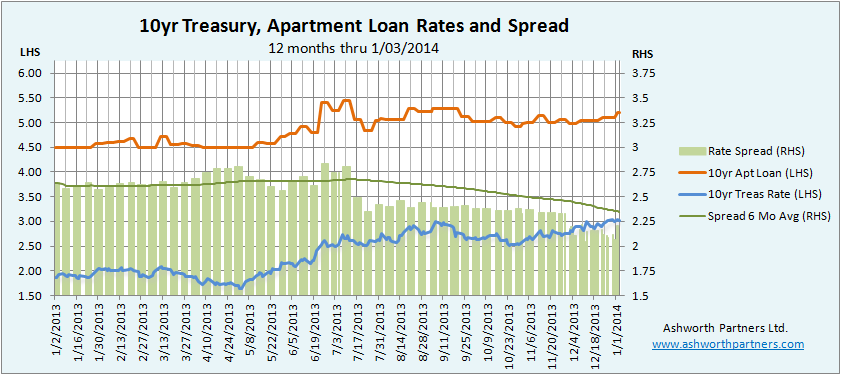

Another major reason for an expected bump in capital available in the next 12 months is that CMBS financing has come back into the multifamily sector—from a volume of practically zero in 2012. They will continue to increase market share significantly in 2014.” Currently, CMBS multifamily financings are carrying interest rates of about 5.10 to 5.20 percent, or about 10 to 15 basis points lower than rates in Fannie Mae transactions, according to Barolak.

Maximum LTVs on CMBS loans—up to 75 percent on 10-year terms for multifamily properties—have also become competitive with those of Fannie and Freddie loans. Moreover, CMBS lenders can become “extremely aggressive” for deals they want to acquire to round up a securitization pool, Barolak says. In such instances, “they can dramatically lower the interest rate significantly below what Fannie and Freddie will offer.”

Life insurance companies are another Continue reading Apartment Building Financing Outlook for 2014