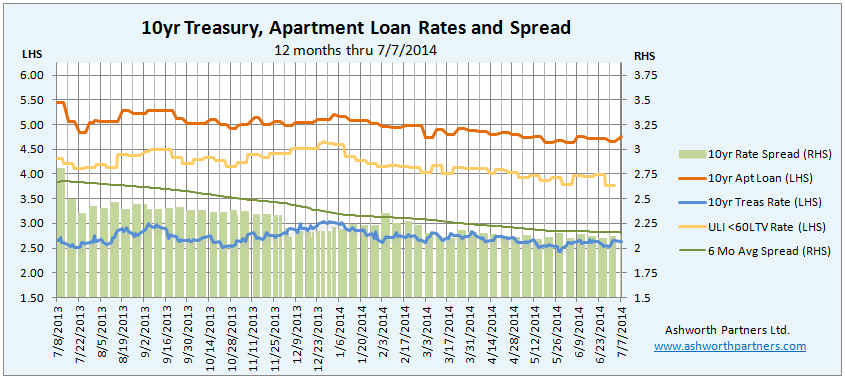

The apartment building loan rate we track came in today at 4.765% (see below for loan details), making it 22 straight weeks below the five percent mark. The spread to the 10 year Treasury (T10) also remained in the 2.1 and change range where it’s been since the beginning of March, indicating that the very competitive market for multifamily loans continues on.

For the gold plated ULI less than 60% LTV loan the spread dropped into the 1.2s from the 1.3 range where it had been holding since late February, taking the implied rate for these core institutional apartment loans down to 3.77%.

Speaking of the spread between the T10 and the Continue reading Apartment Investment Loan Rates Remain in 4.6-4.7% Range As Spread To Treasury 10yr Holds