The Bellingham Apartment Market Report keeps subscribers up to date on the critical market information needed to make good decisions. Whether you are an owner, broker, property manager, builder, lender or investor having access to the Report will help you do what you do best.

- How many new units have been built?

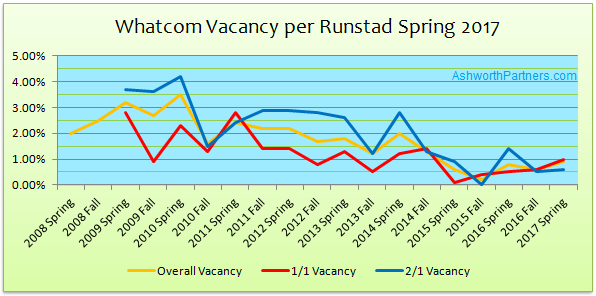

- How is the new supply affecting occupancy?

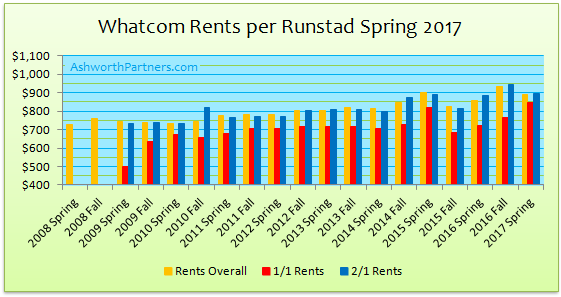

- What are rents doing?

- How many new units are about to be under construction?

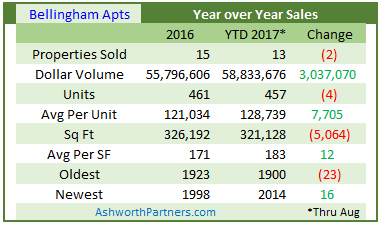

- Is now a good time to sell?

- Who is buying?

- Where are the new owners located?

- What are they paying psf and per unit?

- Or is it better to be buying?

- Who are the sellers and where are they located?

- How long does permitting take for a new apartment building?

- How long does it take to build a new apartment building?

In today’s competitive apartment market the Bellingham Apartment Market Report will provide the advantage you need by providing the critical data and analysis only available to subscribers.

Subscribe now to get the advantage-

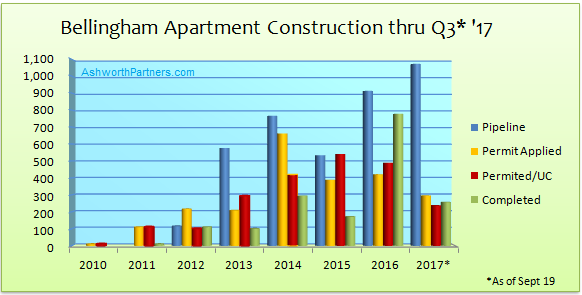

The Report covers planning, permitting and construction data as well as a look at properties that are ‘in the pipeline’; future projects not yet in the permitting phase (See the construction chart sample above).

The Bellingham Apartment Market Report also covers vacancy (above) and rent growth (below).

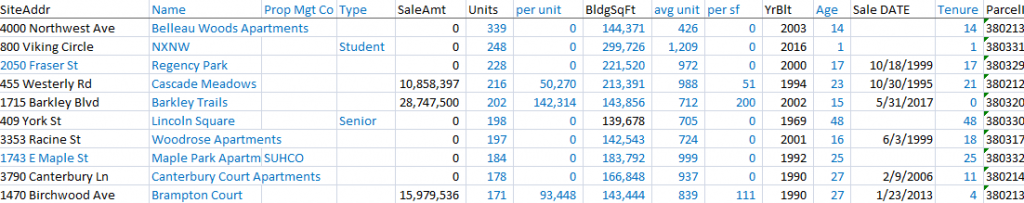

The Report also has the sales database:

And the complete database of all 5+ unit properties and owners in Bellingham:

In addition to the property info the database includes owners and their mailing addresses (subscribers only).

In addition subscribers to The Bellingham Apartment Market Report also receive:

- Monthly updates on sales, construction, permitting and the pipeline.

- Access to private interactive maps of permits, sales and properties.

- Reduced rates on private consulting.