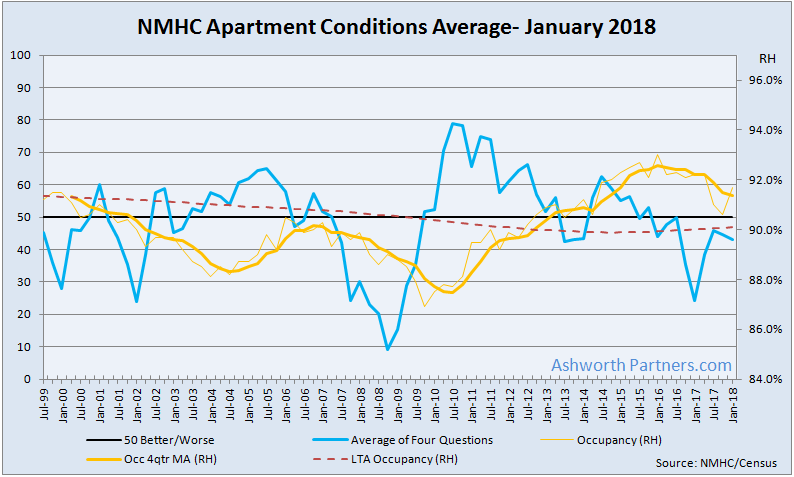

The average of apartment investment conditions tracked by the National Multi Housing Council’s quarterly survey have remained below the 50/50 better/worse level since Continue reading Apartment Conditions Remain Below Par for 9th Straight Quarter

The average of apartment investment conditions tracked by the National Multi Housing Council’s quarterly survey have remained below the 50/50 better/worse level since Continue reading Apartment Conditions Remain Below Par for 9th Straight Quarter

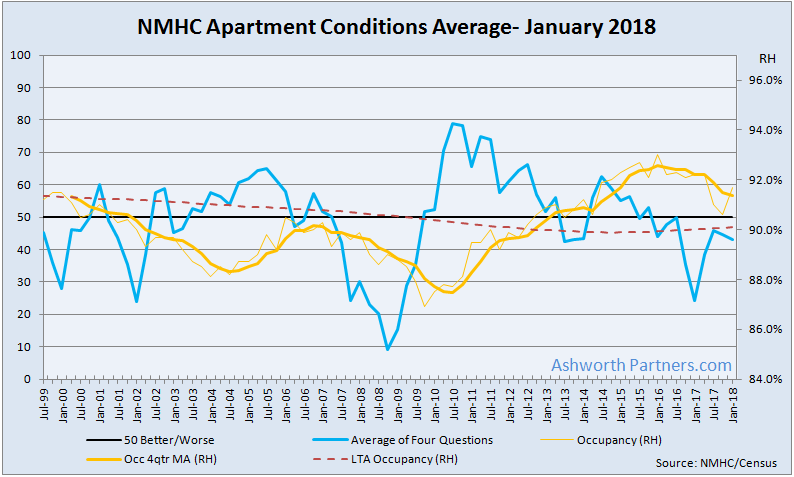

The apartment investment loan rate we track has continued to rise along with the 10yr Treasury (T10), going from 4.76% last month to 4.885% as of yesterday (See below for details on the loans and note that lower rates are available for loans over $5mm). The T10 has gone from 2.46% to 2.65% over the same period with the Continue reading Apartment Loan Rate Rising Along With 10yr Treasury

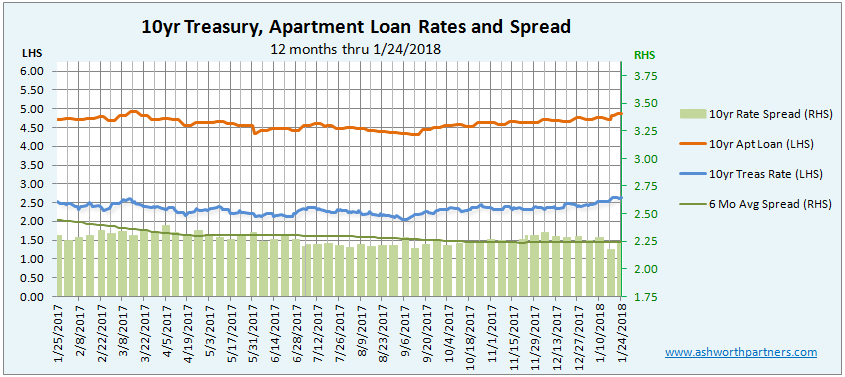

The National Multi Housing Council’s Apartment Conditions average has not been above the 50/50 better/worse level since Q2 2015, coming in at 45 in the latest report. The only index component to Continue reading The NMHC Apartment Conditions Average Remains Below 50 For Q3 2017

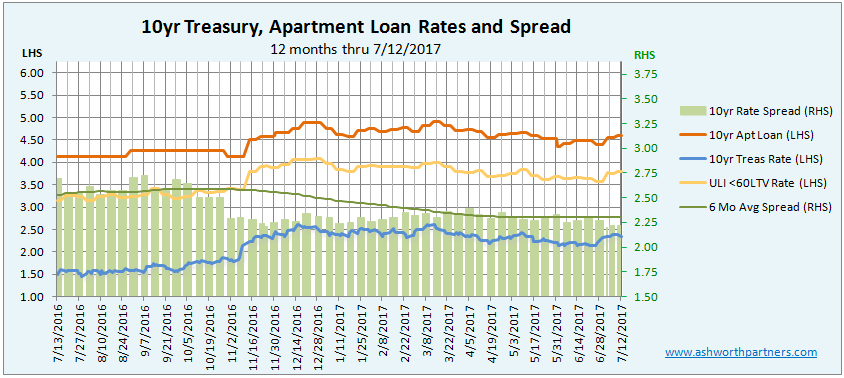

The 10 year apartment investment loan rate we track eased 5 basis points (bp) this week to come in at 4.53%. Both it and the benchmark 10yr Treasury (T10) had been Continue reading Apartment Loan Rate Easing

Developer Bob Hall got his start buying an old building in a deteriorating downtown to house his import business. He didn’t know about due diligence, deferred maintenance or building codes and after having to refinance then sell his house to fund the required repairs swore he’d never buy another building… until he looked at his tax return. He was making more money renting out the extra space than the import business was pulling in… and he was hooked.

At the time Continue reading Rehabbing Historic Apartments and Mixed Use Commercial Buildings

Here’s my Exec sum of their salient points:

The Demographics:

The Competitive Situation:

Continue reading It’s All About the Dogs for Apartment Building Investment

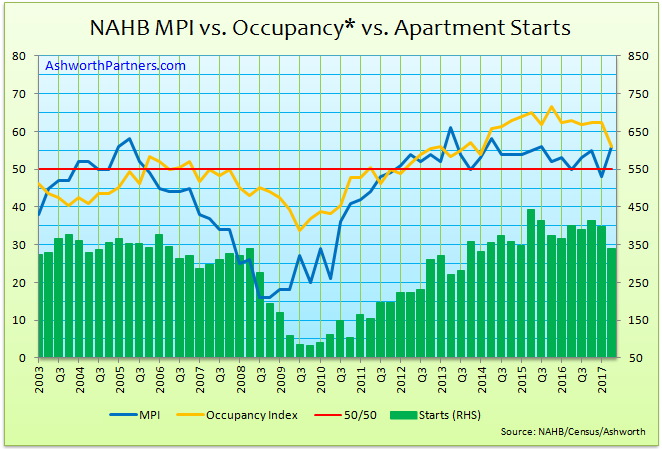

Are apartment builders better predictors of the Apartment Building Investment Cycle? Based on the latest cycle at least (a sample of one, admittedly) it appears that they are.

On the chart above the blue line represents the NAHB’s Multifamily Production Index (MPI) which began falling in the 3rd quarter of 2005 and fell for four straight Continue reading Is Builder Sentiment a Better Predictor of the Apartment Investment Cycle?

The apartment loan rate we track drifted lower since last month, coming in at 4.42% down 18 basis points (bp) from last month’s 4.60%. The spread between the apartment rate and the Continue reading 10 year Apartment Loan Rate Drifts Lower in August

(The Exec Sum for this post is at the end)

Recently I was watching the Harvard Joint Center on Housing’s State of the Nation’s Housing panel discussion which coincided with the release of their annual housing report. On the panel were Terri Ludwig, Enterprise Community Partners CEO; Mayor Catherine E. Pugh of Baltimore as well as Robert C. Kettler, Chairman & CEO, Kettler, a large East Coast developer of tax credit and market rate housing. I thought this particular panel couldn’t have been put together randomly.

The connection to the items in the headline as well as to the people on the panel was a single Continue reading What do FHA mortgages, shopping malls, urban renewal, master planned communities, Architect Frank Gehry and LITCH housing have in common?

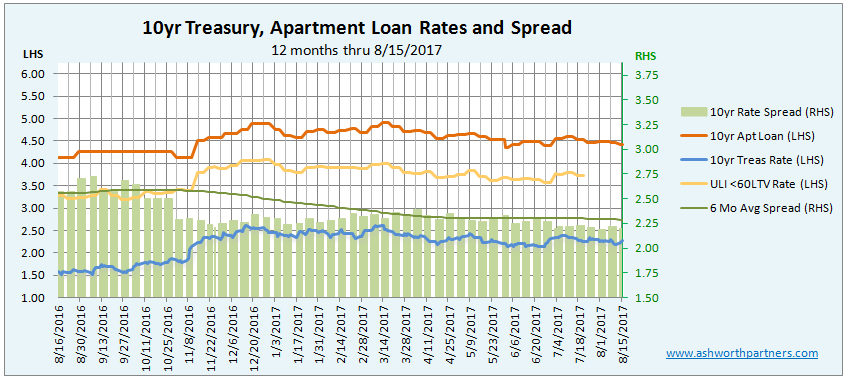

The 10yr apartment loan rate we track rose 12 basis points (bp) to 4.60% from 4.48%, where is was on our report last month. During the same period the 10yr Treasury (T10) rose from 2.21% last month to a high of 2.39% last week before backing off 2bp as of yesterday. What saved the apartment rate from rising 50% further alongside the T10 was that the spread was reduced from a high of 2.9% to 2.22%.

The ULI <60LTV loan we track did not Continue reading Falling Spread Helps Apartment Loan Rate Weather Rise in 10yr Treasuries.