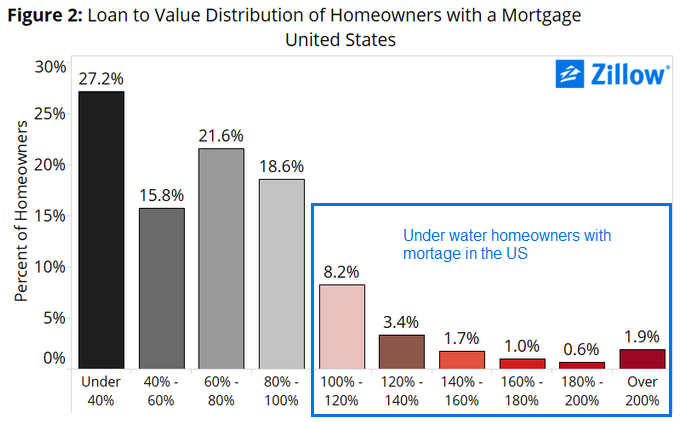

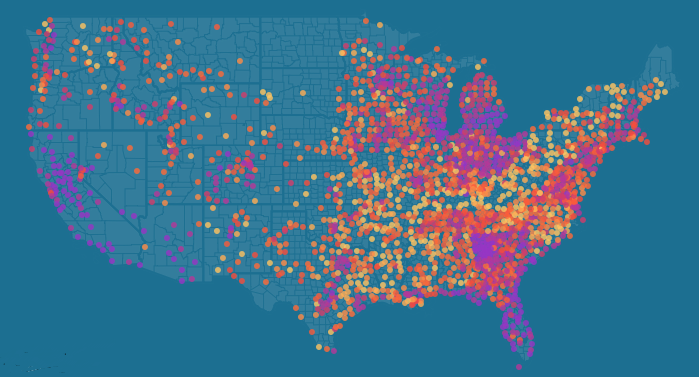

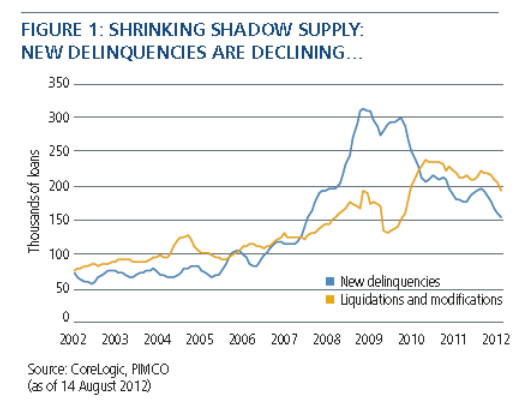

In a piece called Positioning for a Housing Recovery PIMCO says that the risks to housing have been overstated and while prices may continue to fall there are opportunities in the mispricing of that risk. They believe that the risk of the 11 million underwater home loans all becoming delinquent and going into foreclosure is much lower than most think. They also point out that the record low interest rates have created housing demand from large institutions (Like PIMCO, and individual investors too) searching for positive returns.

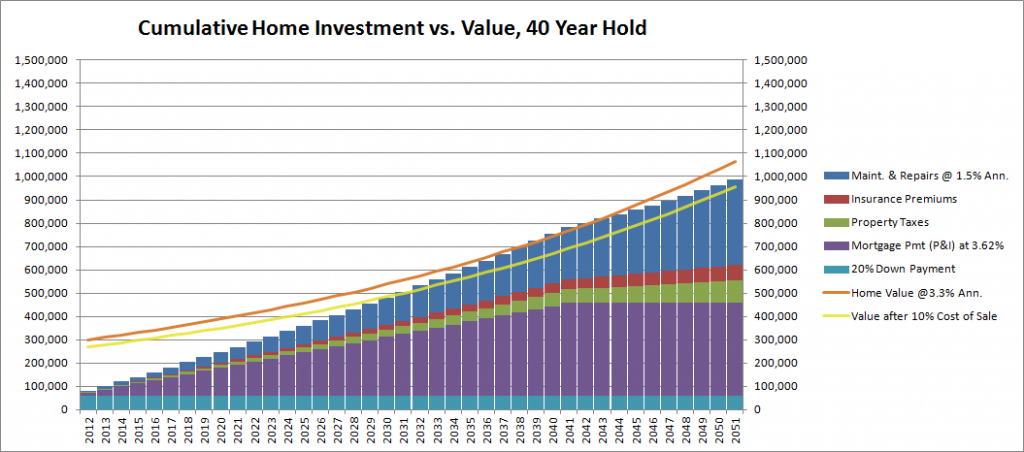

One of the opportunities they list is in apartment building investment, either through equity (owning) or debt (loaning). However they pass over multifamily in favor of REOs-to-rentals and distressed housing debt. It’s ironic that they would favor buying large numbers of single family homes to rent because the logistical nightmare of the scattered homes is what drives most real estate investors to apartments and other commercial real estate. The convenience of having 10, 20, even 200 units or more at one location on a single property on top of the economies of scale available make owning multifamily a much better investment.

While they do acknowledge the challenge of REOs-to-Rentals:

However, investors must be mindful of the operational complexity and illiquidity of a single-family rental portfolio. Managing a nationally diversified portfolio of rental properties presents unique challenges of surveillance and scaling, and procedures for maintenance and leasing must be designed to help protect earnings.

… Somehow that doesn’t lead them to picking multifamily investment. Are you a real estate investor who started out in single family properties and moved on to apartment buildings? We would love to hear your story-

Hat tip: The Big Picture blog