Forbes put out a piece with a slide show of the best and worst places to rent an apartment; my question is wouldn’t you want to own an apartment building investment in one of the top 10 cities? How about in any of the other cities listed?

One of the factors they used was the cost of renting vs. owning but the ownership cost is lowballed because it only includes the house payment (mortgage, taxes, insurance), ignoring the true cost which also includes maintenance, repairs and reserves for capital improvements… not to mention coming up with 20% down payment and qualifying for a loan. Even still renting comes out looking pretty good in those places.

Then in a WSJ piece in their Smart Money section there’s this: “On the national level, it is cheaper to buy than rent, according to a March 2012 report by Deutsche Bank – even after taking into account the down payment and property taxes. But in some areas, including California and the Northeast, renting remains more affordable than buying. The report identified 13 cities where renting costs less than the after-tax mortgage payment (that’s the mortgage expenses the owner incurs, along with the mortgage interest deduction they get come tax season).”

Once again ignoring the true cost of owning which includes keeping the place up, yardwork, painting plus fixing things that break like appliances, furnaces, hot water tanks, and setting aside something for things that wear out like the roof and the driveway. They list five markets where even lowballing the cost of owning it is still cheaper to rent:

- Northern NJ

- Long Island, NY

- California

- Honolulu

- Seattle

In my hometown of Seattle they picked some interesting neighborhoods for examples but found on average that even without factoring in repairs, maintenance and capital improvements renting averaged $377 per month less than owning.

Net, net renting is a better deal in many places even if you could afford the downpayment and qualify for a loan.

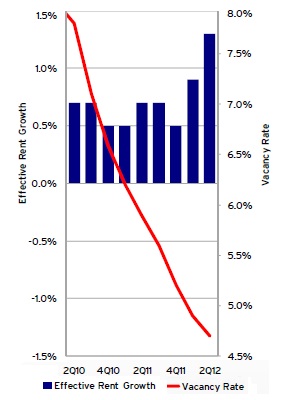

How are vacancy and effective rents trending in your market?

How are vacancy and effective rents trending in your market?