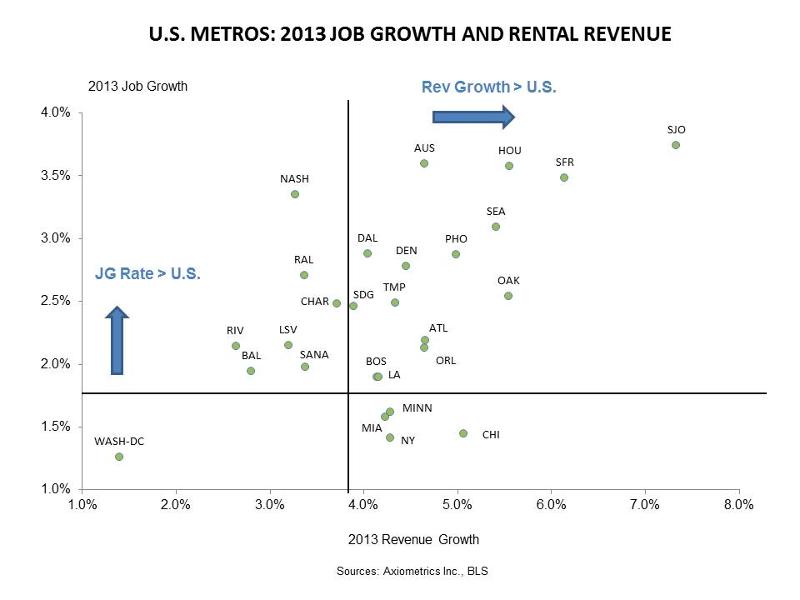

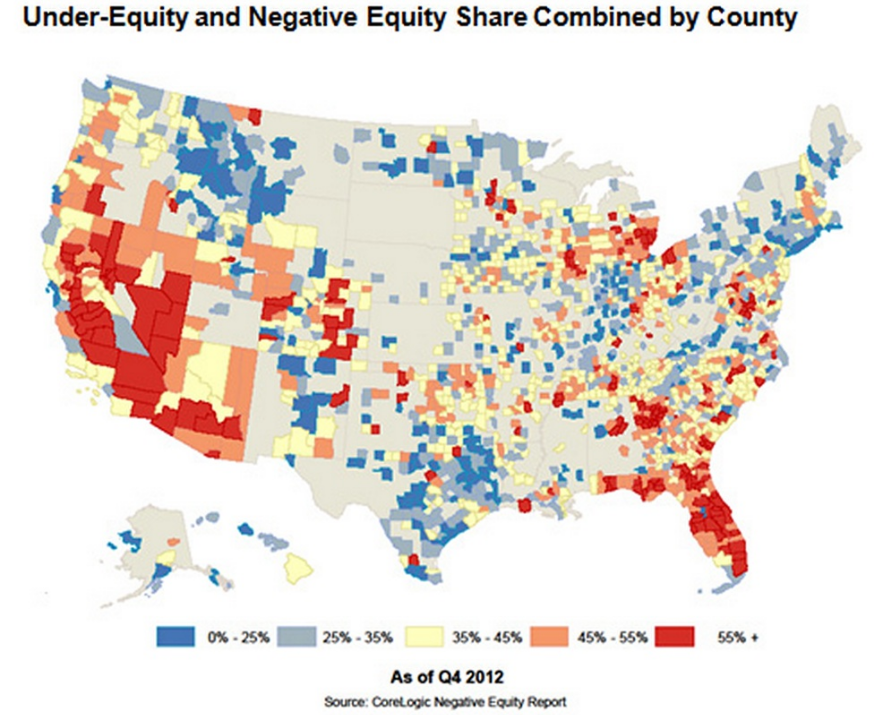

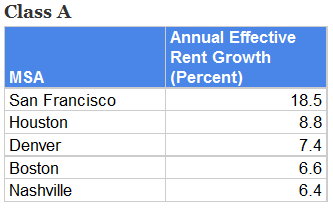

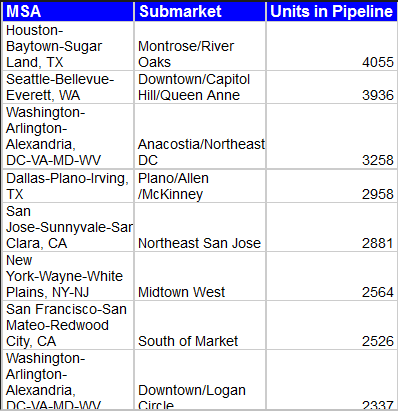

A lot of the usual suspects when it comes to multifamily markets have moved pretty far into their cycles and if your home area is like ours ti’s getting pretty fully priced. With our value investor mindset that means we’re looking for the next markets to do well over the coming 10-20 years. As apartment building investors we say:

Fortunately two different sources provided data and maps to answer Jerry’s demand. The first is from the NAHB (the National Association of Home Builders) in an Eye On Housing piece called Uneven Aging. The report actually has two maps, the first showing the 2000 to 2010 growth in the Continue reading Skate to where the apartment building investment puck is going: Top US markets for future population and job growth.