MHN Online has an interview with Dean Henry, president of Legacy Partners Residential, one of the big apartment building investment trusts (REITs). What I like is that he speaks in bullet points, just the way I think! Here’s my exec sum (in bullet points) of his bullet points:

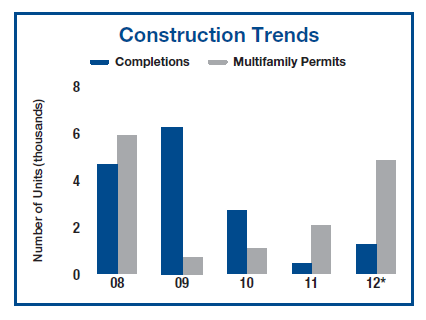

“There are several important reasons why now is a great time to acquire existing multifamily assets. Let’s start with demand and supply:

- The U.S. population is increasing by approximately 3 million people per year, plus the legal immigrants who enter the country, and 75 to 85 percent of whom rent rather than buy.

- Secondly, the 18- to 35-year-old population totals approximately 65 million and will be Continue reading Is now a good time to make Apartment Building Investments?