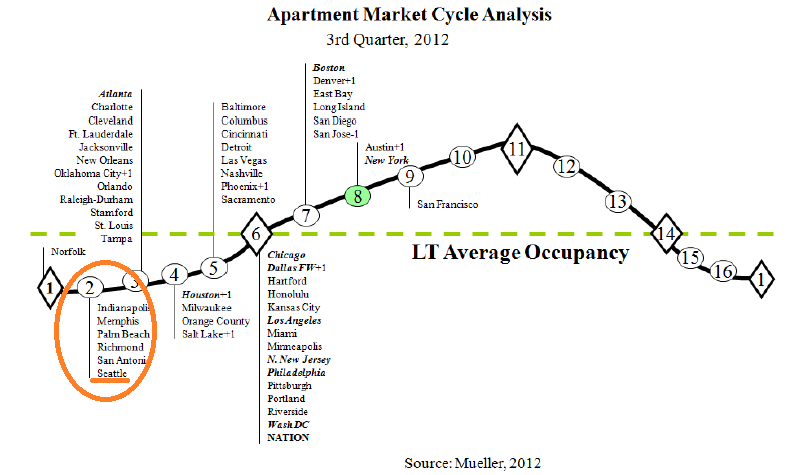

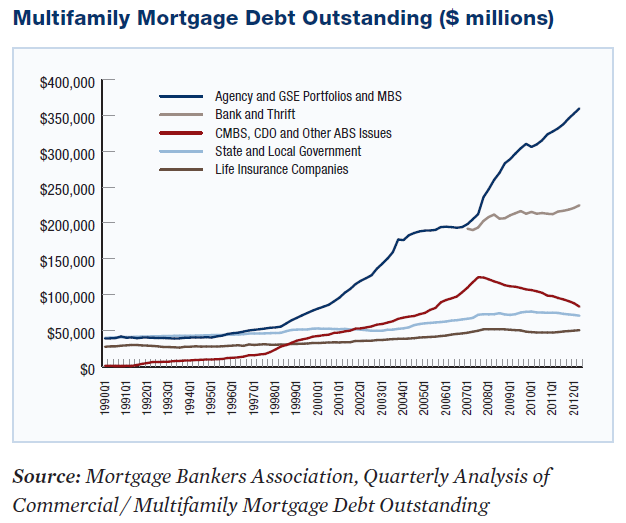

The Mortgage Bankers Association is out today with a white paper “Ensuring Liquidity And Stability: The Future Of Multifamily Housing Finance And The Government-Sponsored Enterprises“. (or see the MHN exec sum here) The paper highlights the role of the GSEs (Government Sponsored Enterprises, i.e. FNMA ‘Fannie Mae’ and FHLMC ‘Freddie Mac’) in today’s multifamily finance market and presents five recommendations for the future making their points with a set of charts that demonstrate the size of their role in multifamily as well as the very low amount of bad loans they’ve made in the sector.

- Our nation’s housing policies should reflect the importance of multifamily rental housing, the range of capital sources that support this market, and the need for liquidity and stability in all market cycles.

Continue reading MBA: GSEs vital in Ensuring Liquidity and Stability in apartment building investment finance.

Continue reading MBA: GSEs vital in Ensuring Liquidity and Stability in apartment building investment finance.