James Montier, who works at the intersection of value investing and behavioral investing (Author of ‘The Little Book of Behavioral Investing’ http://amzn.to/X9Olzc on Amazon among others) has a great quote in his latest white paper published by GMO Global Investment Management entitled “The 13th Labour of Hercules:Capital Preservation in the Age of Financial Repression” Note that you may have to register at the site (free).

His paper discusses the effects of financial repression on portfolio stock and bond allocations and by implication the effects on real estate and particularly apartment building investments. Financial repression is the term used to describe central bank’s strategies for forcing interest rates to zero or negative to spur investment and spending at the expense of saving. Take it away James:

William McChesney Martin was the longest-serving Federal Reserve Governor of all time. He is probably most famous for his observation that the central bank’s role was to “take away the punch bowl just when the party is getting started.” In contrast, Bernanke’s Fed is acting like teenage boys on prom night: spiking the punch, handing out free drinks, hoping to get lucky, and encouraging everyone to view the market through beer goggles. [Emphasis mine]

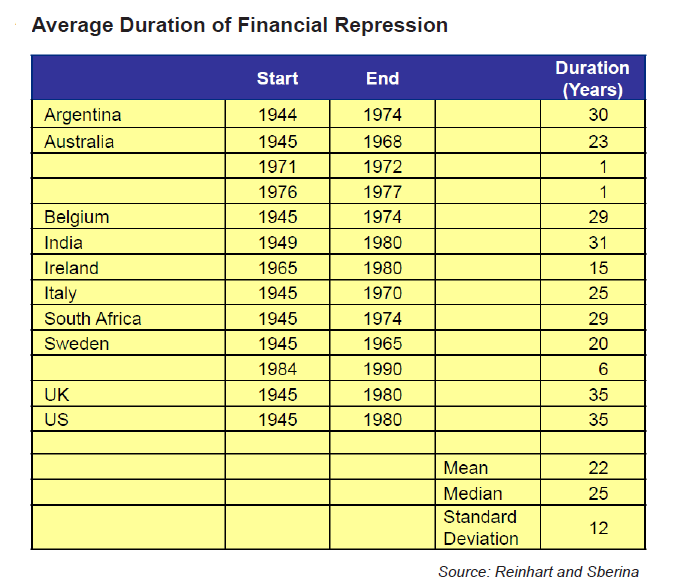

The paper goes into depth on the effects of financial repression on investments, which grow the longer the repression lasts, up to twenty years. Does the phrase: “… for an extended period” ring a bell? How about QE1, QE2, QE3, and now QE-infinity?

Apartment buildings are the real estate equivalent of Continue reading The Federal Reserve and Beer Goggles plus what Financial Repression means for Apartment Building Investments