Great MFE article on apartment building investment niche strategies from teams who battle the big guys and win. Five different teams and strategies are profiled and they all have something to teach but I wanted to highlight one company whose strategy is very similar to ours. Here’s my exec sum in bluue:

LumaCorps Apartment Building Investment Strategy

LumaCorp. quietly owns and operates a 4,800-unit portfolio of 1980s, Class B properties managed to meet the needs of working-class renters.

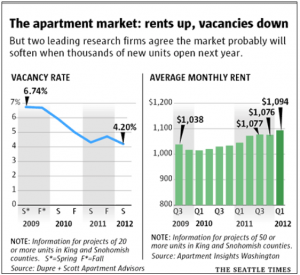

These [renters] historically can’t buy a house, but they still want clean, quality, safe housing. We think it’s a much bigger slice of the market than other renter demographics.

Rent growth can be modest, but that’s OK. One of the advantages of owning property in small tertiary markets is that they are less active [in terms of new construction and competition, the rent growth is more predictable.

LumaCorp. begins with old-fashioned real estate research, looking for distressed or underperforming working-class properties with potential. “We make money by fixing problems.”

But the firm isn’t interested in just any Class B property with deferred maintenance and an attractive price.

We’re very picky about the properties we acquire

We know our market very well, and we know what works in terms of floor plans, unit mix, and architectural designs.

We pick a property with good bones, and then we invest the money to bring it up to our standards.

LumaCorp. runs some of the tighter costs, yet when you drive up to the property, it always looks terrific. Some multifamily firms spend lots of money, and their properties still look tired.

Only a few properties will make the cut for the LumaCorp. treatment. “We might look at 100 packages. Out of that, we’ll find 20 worth looking at, and 10 will get offers. One might get done,” says Kelly, who made “a couple dozen offers” in 2011 and got one—Bardin Oaks in Arlington, Texas.

See the whole MFE Mag article here: Niche Guys Win