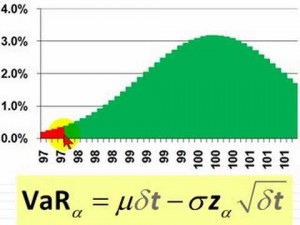

This article argues that the crisis of 2007–2008 happened because of an explosive combination of agency problems, moral hazard, and “scientism”—the illusion that ostensibly scientific techniques would manage risks and predict rare events in spite of the stark empirical and theoretical realities that suggested otherwise.

Conclusion: “The captain goes down with the ship; every captain and every ship.” Nobody should be in a position to have the upside without sharing the downside, particularly when others may be harmed. While this principle seems simple, we have moved away from it in the finance world, particularly when it comes to financial organizations that have been deemed “too big to fail.”

WARNING: Math speak ahead (but no formulas or equations) and several Nobel winning oxen are gored.

The best risk-management rule was formulated nearly 4,000 years ago. Hammurabi’s code specifies:

“If a builder builds a house for a man and does not make its construction firm, and the house which he has built collapses and causes the death of the owner of the house, that builder shall be put to death.

Clearly, the Babylonians understood that the builder will always know more about the risks than the client, and can hide fragilities and improve his profitability by cutting corners—in, say, the foundation. The builder can also fool the inspector (or the regulator). The person hiding risk has a large informational advantage over the one looking for it.

And it gets better from there: How to Prevent Other Financial Crises by Nassim Nicholas Taleb and George A. Martin

For a different take on the causes of the financial collapse see: Barry Ritholtz on Causes of the Financial Crisis

Great quote from Barry Ritholtz that ties both articles together:

[A]cademic economists – and especially the Chicago School and other believers in the Efficient Market Hypothesis (EMH) – got this totally wrong. There’s a simple reason for that, which is that when you build a model, you’re building a Platonic shadow of reality. It’s not reality; it’s a depiction of reality. Naturally, there’s going to be some variance and modelling errors. There’s that great George Box quote: “All theoretical models are wrong, but some are useful.” What that means is that you have to always remember, when you’re working from a model, especially a financial model making projections into the future, that you’re not dealing with a perfect reflection of everything that takes place in the real world. There are irrational things that take place that models typically don’t forecast. Human beings are not perfectly efficient, profit-maximising actors.

But wait, there’s more: Michael Mauboussin and Ole Peters discuss some math errors at the foundation of economics that make a difference and that difference can be huge when leverage is involved. http://bit.ly/HndVDM