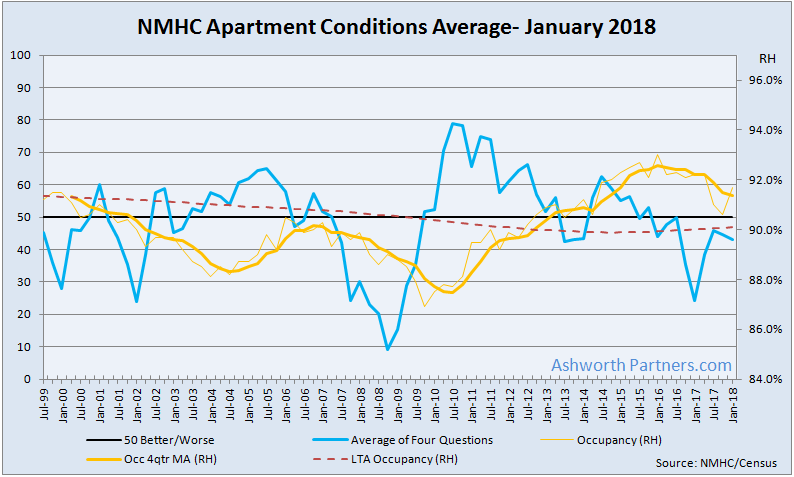

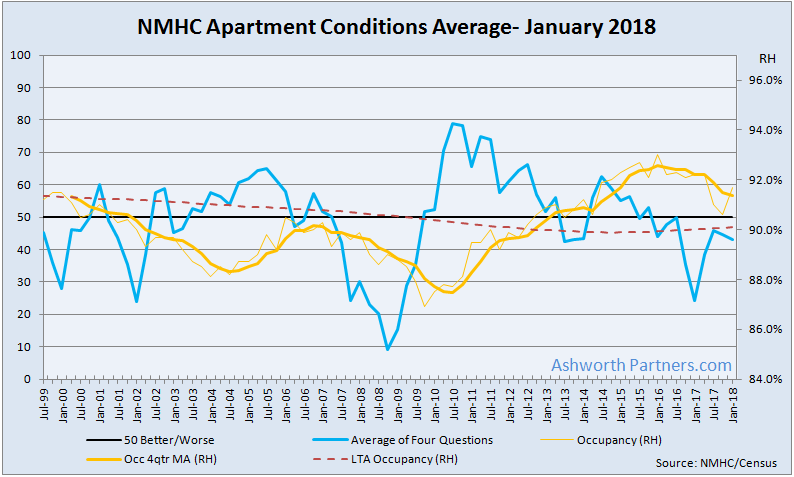

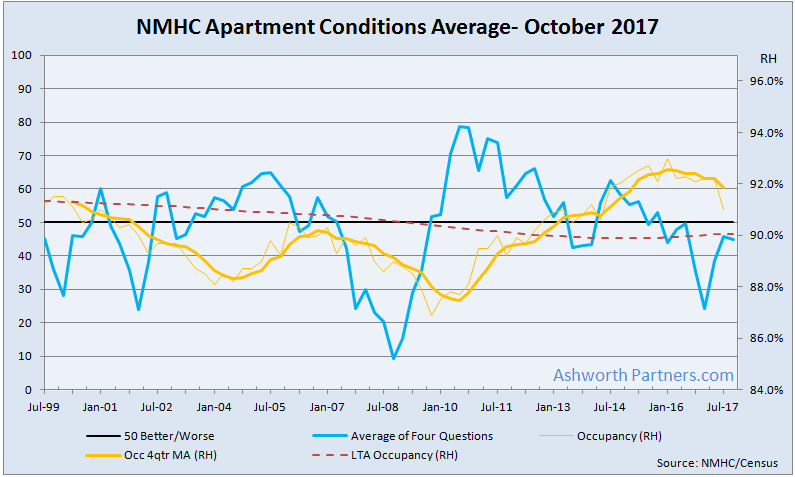

The average of apartment investment conditions tracked by the National Multi Housing Council’s quarterly survey have remained below the 50/50 better/worse level since Continue reading Apartment Conditions Remain Below Par for 9th Straight Quarter

The average of apartment investment conditions tracked by the National Multi Housing Council’s quarterly survey have remained below the 50/50 better/worse level since Continue reading Apartment Conditions Remain Below Par for 9th Straight Quarter

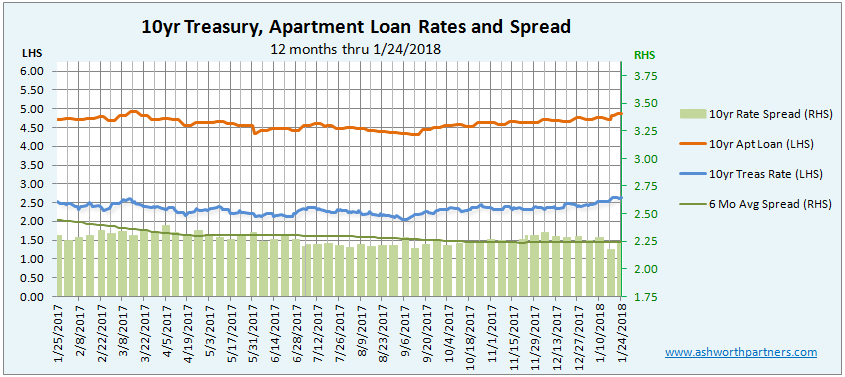

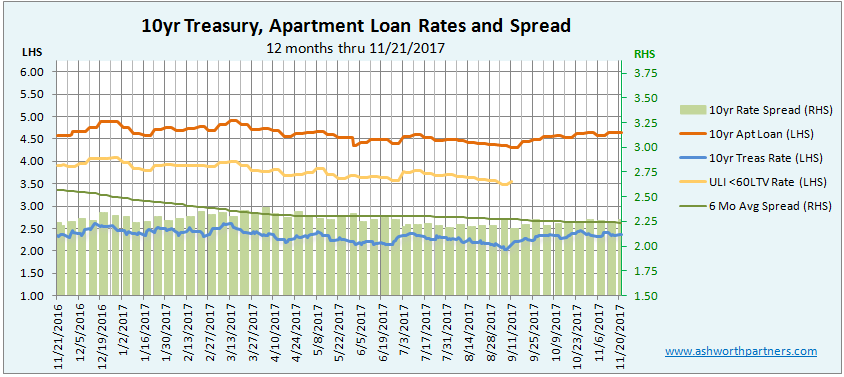

The apartment investment loan rate we track has continued to rise along with the 10yr Treasury (T10), going from 4.76% last month to 4.885% as of yesterday (See below for details on the loans and note that lower rates are available for loans over $5mm). The T10 has gone from 2.46% to 2.65% over the same period with the Continue reading Apartment Loan Rate Rising Along With 10yr Treasury

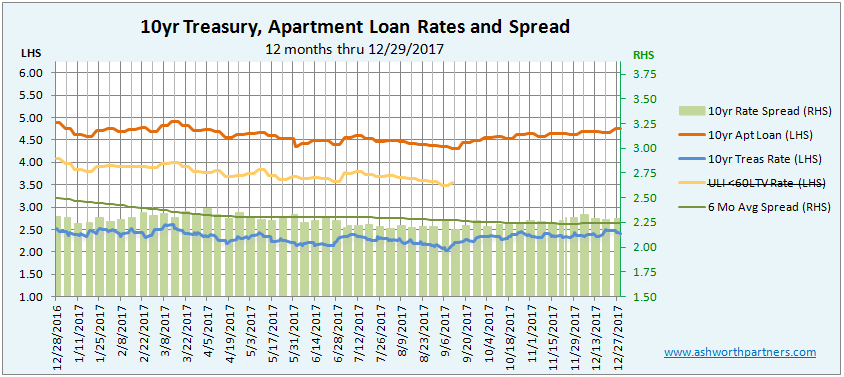

The apartment building investment loan rate we track ended the year 12 basis points (bp) lower than year-end 2016 at 4.76% (see below for details on this loan rate). At the same time the Continue reading Apartment Loan Rate Ends Year Lower Than Last

The apartment building investment loan rate we track remains above 4.5% where it has been since the end of September, coming in at 4.64% as of yesterday. The spread between it and the benchmark 10 year Treasury (T10) has widened, but only by 4 basis points (bp) since last month’s report.

Speaking of the T10, a funny thing happened on the way to the forum this month; the curvature of Continue reading Apartment Loan Rate Holds Above 4.5%

The National Multi Housing Council’s Apartment Conditions average has not been above the 50/50 better/worse level since Q2 2015, coming in at 45 in the latest report. The only index component to Continue reading The NMHC Apartment Conditions Average Remains Below 50 For Q3 2017

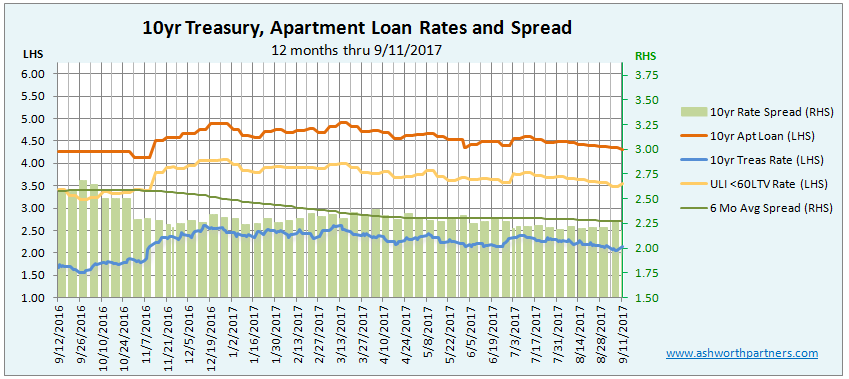

The 10 year apartment investment loan rate we track eased 5 basis points (bp) this week to come in at 4.53%. Both it and the benchmark 10yr Treasury (T10) had been Continue reading Apartment Loan Rate Easing

Developer Bob Hall got his start buying an old building in a deteriorating downtown to house his import business. He didn’t know about due diligence, deferred maintenance or building codes and after having to refinance then sell his house to fund the required repairs swore he’d never buy another building… until he looked at his tax return. He was making more money renting out the extra space than the import business was pulling in… and he was hooked.

At the time Continue reading Rehabbing Historic Apartments and Mixed Use Commercial Buildings

Here’s my Exec sum of their salient points:

The Demographics:

The Competitive Situation:

Continue reading It’s All About the Dogs for Apartment Building Investment

First I want to take a moment to remember all those who lost or gave their lives as well as their families and friends that terrible day sixteen years ago. I have four friends who but for their own unique twists of fate would have been in the twin towers on 9/11 and their good fortune is a stark reminder of so many who weren’t that lucky. Also I keep in my thoughts all those who are suffering because of wild fires, hurricanes, floods and earthquakes around the world right now. – Giovanni

The 10 year apartment investment loan rate we track fell 10 basis points (bp) from last month even though the benchmark 10yr Treasury rate jumped 8bp today to 2.14%. The spread between the two shrank to 218bp, the Continue reading Falling Spread Prevents Apartment Investment Loan From Jumping

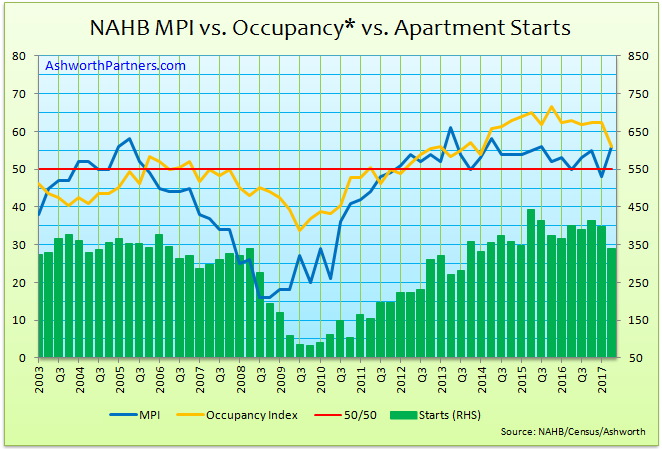

Are apartment builders better predictors of the Apartment Building Investment Cycle? Based on the latest cycle at least (a sample of one, admittedly) it appears that they are.

On the chart above the blue line represents the NAHB’s Multifamily Production Index (MPI) which began falling in the 3rd quarter of 2005 and fell for four straight Continue reading Is Builder Sentiment a Better Predictor of the Apartment Investment Cycle?