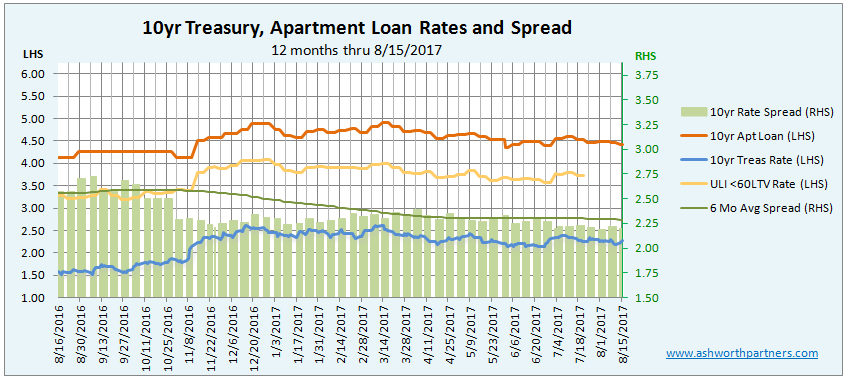

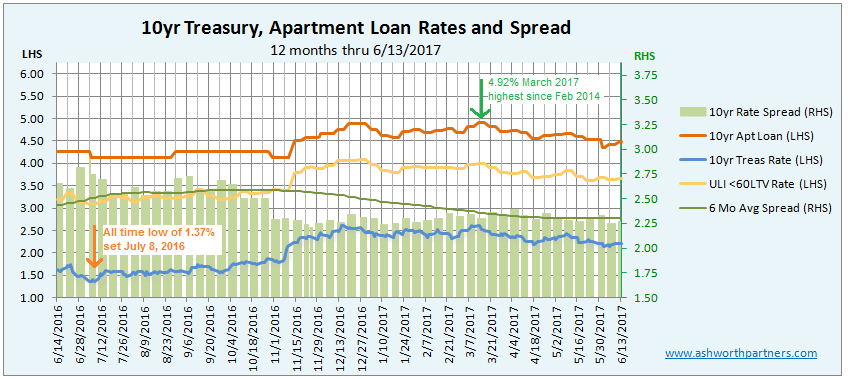

The apartment loan rate we track drifted lower since last month, coming in at 4.42% down 18 basis points (bp) from last month’s 4.60%. The spread between the apartment rate and the Continue reading 10 year Apartment Loan Rate Drifts Lower in August

The apartment loan rate we track drifted lower since last month, coming in at 4.42% down 18 basis points (bp) from last month’s 4.60%. The spread between the apartment rate and the Continue reading 10 year Apartment Loan Rate Drifts Lower in August

(The Exec Sum for this post is at the end)

Recently I was watching the Harvard Joint Center on Housing’s State of the Nation’s Housing panel discussion which coincided with the release of their annual housing report. On the panel were Terri Ludwig, Enterprise Community Partners CEO; Mayor Catherine E. Pugh of Baltimore as well as Robert C. Kettler, Chairman & CEO, Kettler, a large East Coast developer of tax credit and market rate housing. I thought this particular panel couldn’t have been put together randomly.

The connection to the items in the headline as well as to the people on the panel was a single Continue reading What do FHA mortgages, shopping malls, urban renewal, master planned communities, Architect Frank Gehry and LITCH housing have in common?

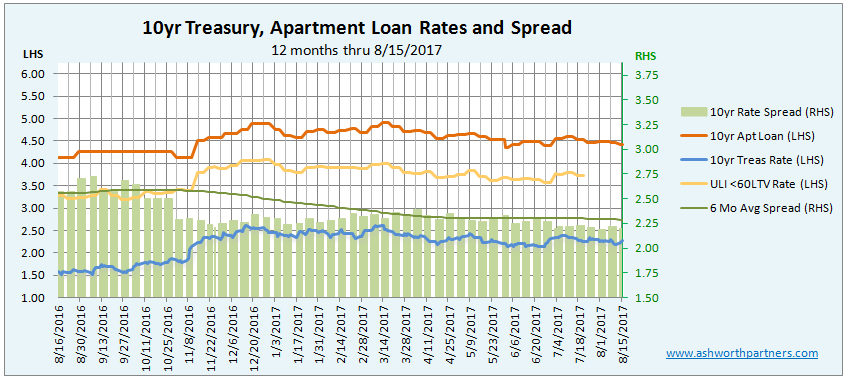

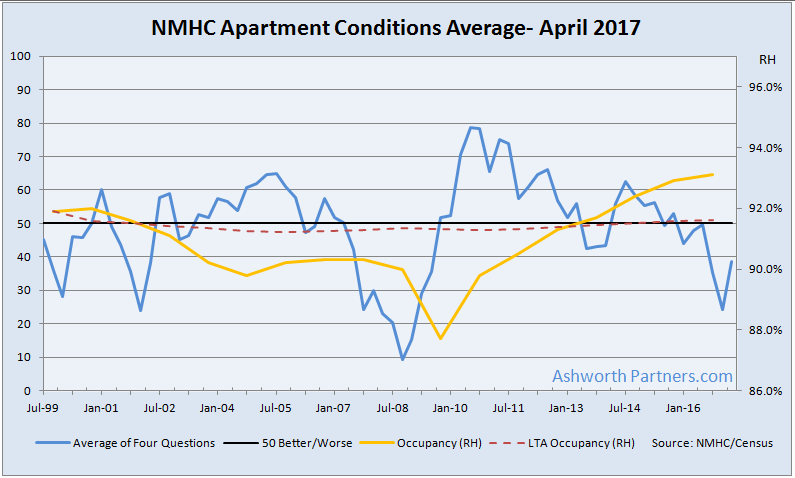

All four of the indexes in National Multi-Housing Council’s July survey improved but remained below the 50 better/worse boundary bringing the average up to 46 from 39.

The biggest improvement was in the Continue reading Apartment Conditions Improve But Still Below Par- NMHC July Survey

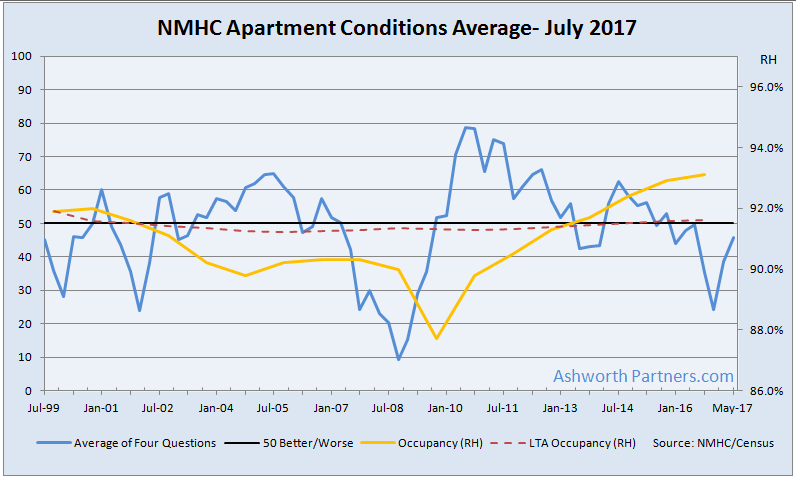

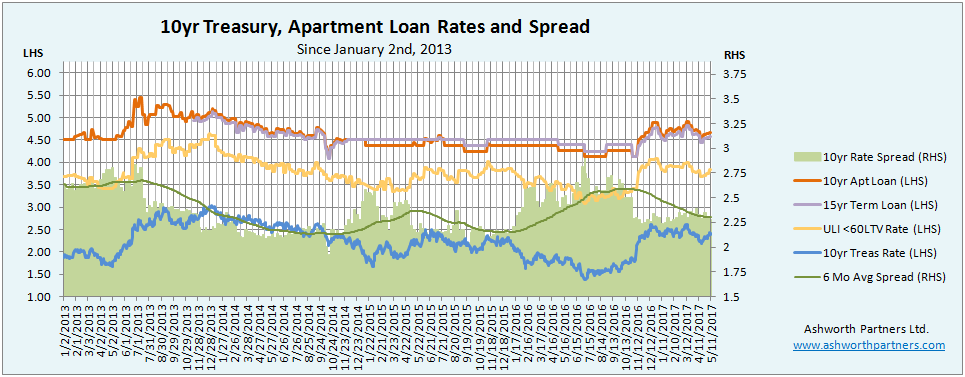

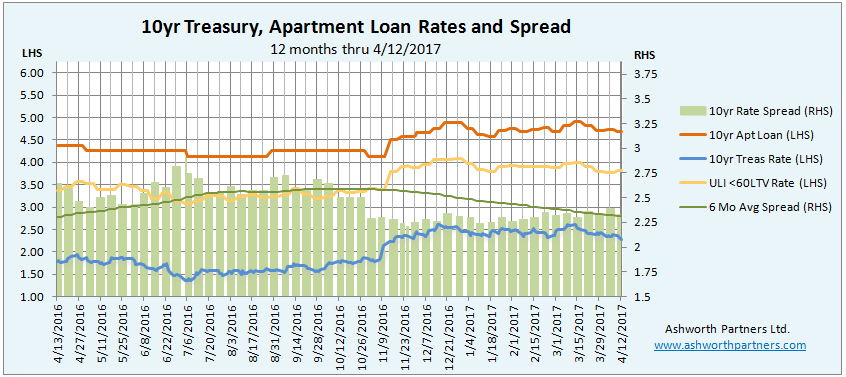

The 10yr apartment loan rate we track rose 12 basis points (bp) to 4.60% from 4.48%, where is was on our report last month. During the same period the 10yr Treasury (T10) rose from 2.21% last month to a high of 2.39% last week before backing off 2bp as of yesterday. What saved the apartment rate from rising 50% further alongside the T10 was that the spread was reduced from a high of 2.9% to 2.22%.

The ULI <60LTV loan we track did not Continue reading Falling Spread Helps Apartment Loan Rate Weather Rise in 10yr Treasuries.

Quote: “[A] very active market that continues to give strong weighting to underlying land value and potential future use, even if this use is far off in the future.” – James Glen, VP, Colliers Vancouver, BC [Emphasis mine]

Any time you see future and potential in the same sentence referring to real estate, watch out…

Oh and another sign is when the average cap rate for a low-rise apartment deal is 3% while high-rises are at 2.5! Just for reference, a 2.5 cap is the equivalent of a 40x multiple (aka PE or Price Earnings Ratio) on a stock meaning that it would take 40 years of earnings (NOI in the case of real estate) to repay the purchase price and that is definitely “far off in the future“.

You can see all the Canadian Cap Rate reports from Colliers here: Canada Cap Rate Report Q1 2017

Happy summer everyone-

P.S. If you’d like a handy chart for converting Cap Rates to Earnings Multiples shoot me a message with Cap Rates to Earnings in the subject line.

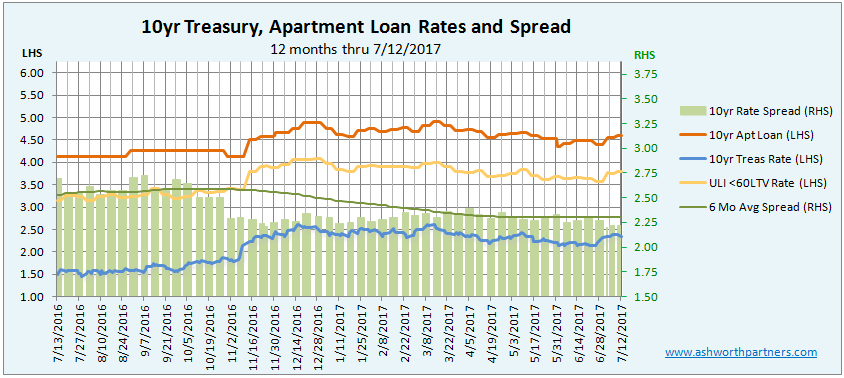

The apartment investment loan rates we track have continued their downward trend. In March the 10yr loan (details below) hit 4.92%, the highest its been since February 2014, and has drifted lower since coming in at 4.48% this week. That and the Continue reading Apartment Loan Rates Continue To Drift Lower- June 2017

The Bullets

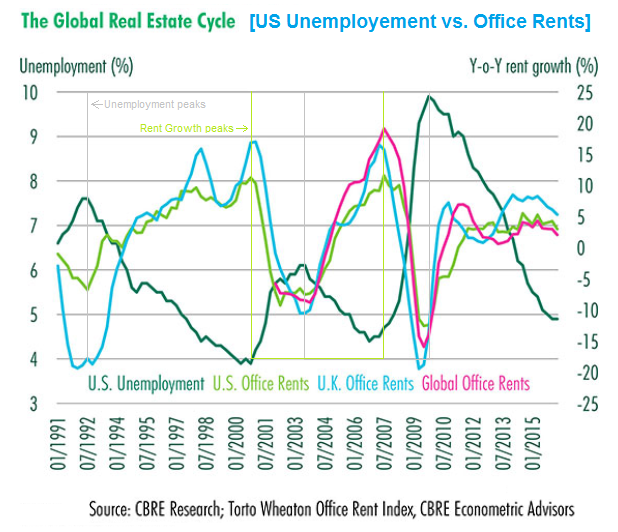

In his latest Ahead of the Curve piece, Richard Barkham, Ph.D., CBRE Global’s Chief Economist explores whether the commercial real estate cycle turns down in 2018 or extends beyond for a year or two. His conclusion is a version of Harry Truman’s Continue reading Are We Looking At An Extended CRE Cycle? What About Apartments?

The apartment investment loan rate we track remains in the range of 4.51 – 4.92% where it’s been since the election six months ago, coming in at 4.67% this week. Now that range sure looks different than the one it was in Continue reading Apartment Loan Rate Update May 2017 – A Different Kind of Range

The latest NMHC Quarterly Survey of Apartment Market Conditions average remains in negative territory; marking its third consecutive quarter below 40. The average has now been at or below 50 Continue reading Apartment Investment Conditions Still Negative- NMHC Quarterly Survey

The 10 year apartment investment loan rate we track has been following the T10 (10yr Treasury) lower since we reported on them last month. The T10 has fallen from 2.51% to 2.28 and the apartment rate from 4.92% to 4.7. The Treasury is back to a level last seen Continue reading 10 Year Treasury and Apartment Loan Rates Trending Down Since Last Month