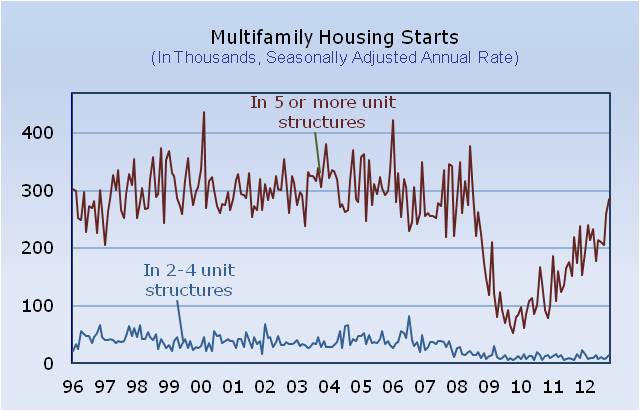

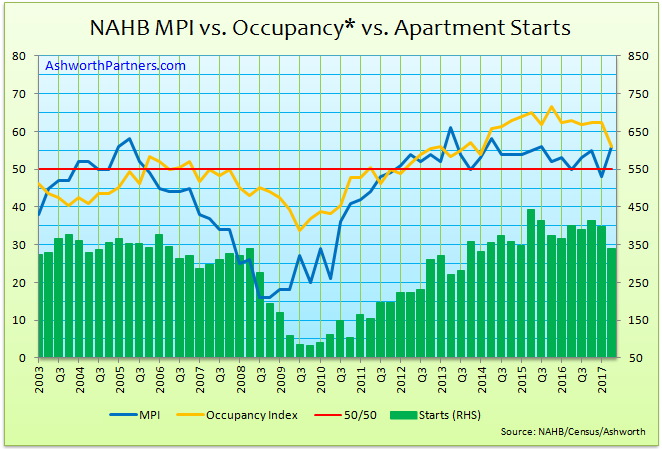

Are apartment builders better predictors of the Apartment Building Investment Cycle? Based on the latest cycle at least (a sample of one, admittedly) it appears that they are.

On the chart above the blue line represents the NAHB’s Multifamily Production Index (MPI) which began falling in the 3rd quarter of 2005 and fell for four straight Continue reading Is Builder Sentiment a Better Predictor of the Apartment Investment Cycle?