HUD and the Census Bureau released the latest version of the Rental Housing Finance Survey. The “Survey fills an important gap in our understanding of who owns multifamily rental housing – mostly individuals, not large companies — and how multifamily rental housing is financed, especially as the structure of finance is changing. In light of recent changes in the availability of capital for rental housing, the Rental Housing Finance Survey also provides important insight about the financial health and stability of multifamily housing properties.” said Erika Poethig, HUD’s Deputy Assistant Secretary for Policy Development.

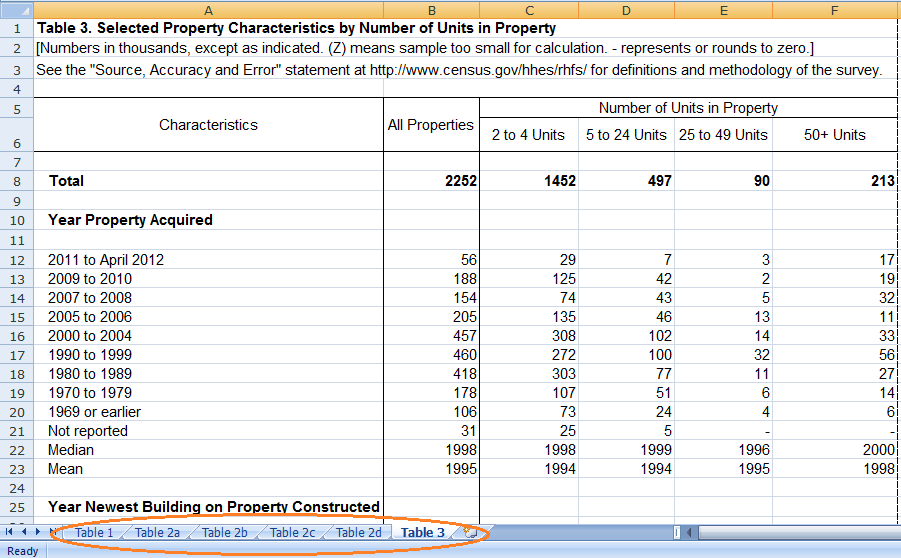

This is one table from the xls on the Census Bureau’s site here. Note the tabs on the bottom which have the data broken out by different types.

A few bullet points from HUD’s release linked at the top of the post:

- Approximately 20 percent of American households live in multifamily rental buildings.

- There are 2.3 million such properties in the United States.

- 73 percent are just one Continue reading New Stats from HUD/Census apartment building finance survey