There have been a number of reports recently claiming that renting is more expensive than buying a house. This is a great thing as everyone involved in selling, building and financing houses would tell you, especially if it were true. Unfortunately it is not for a variety of reasons, one of them being that owning the home you live in just isn’t that good of an investment, but we’ll get to that in a moment.

The first hurdle is the challenge of amassing the 20% down payment. On the average US home price of $242,300 the downpayment would be $48,460. That is essentially one whole year’s worth of the US median income of $51,413, so the question is how long would it take someone to save that much? This question is nearly always ignored in these comparisons. But say we all have a rich relative who leaves us the downpayment in their will, it’s all good after that right?

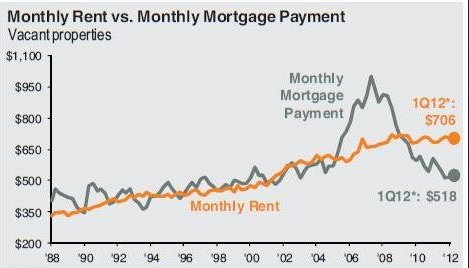

Some of these type of reports simply compare the average local rent to the mortgage payment for the area’s average home and therefore can be discounted out of hand. Others include taxes and insurance which is slightly better but they are still missing a very big piece of the cost of owning and operating a home; repairs and maintenance. Continue reading Rent Vs. Buy And The Great Myth of Homeownership as an ‘Investment’