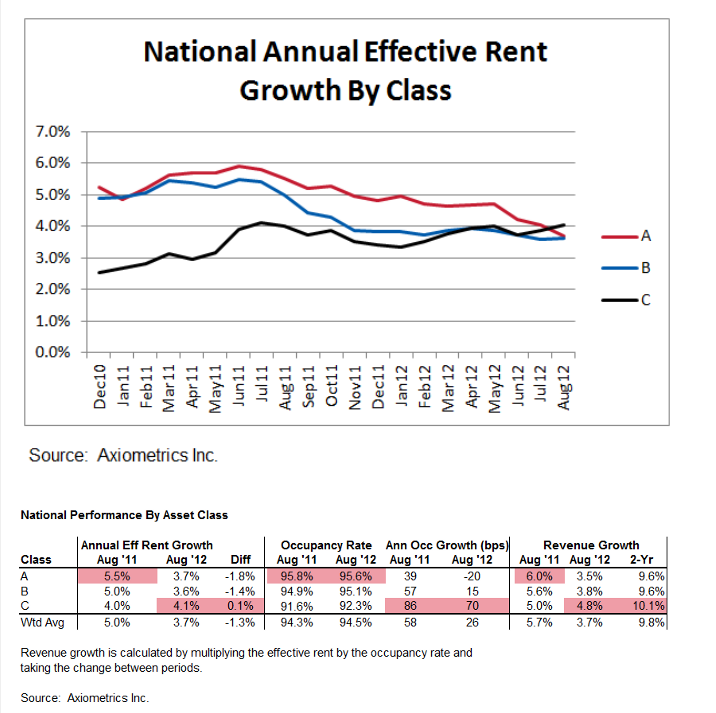

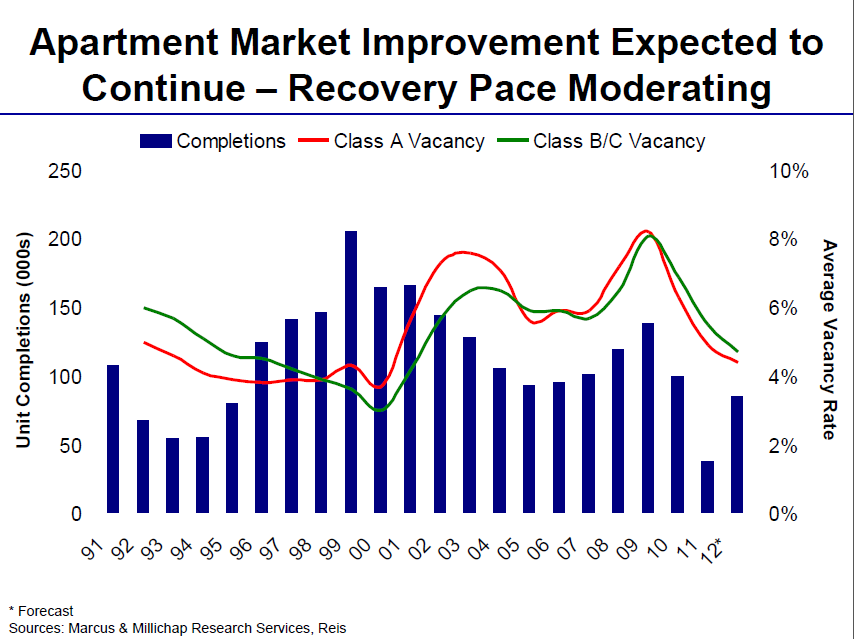

From their latest National Monthly Trends report: Class C properties took the lead for annual effective rent growth in August. Class A properties had been the leader in that category as the apartment market improved over the past few years, but the Class A annual growth rate slowed from 4.73% in May to 3.70% in August. Why has the growth rate slowed so much in just the past few months? Is it tied to job growth, which weakened in May? Is the first wave of new supply starting to impact performance as we show new apartment deliveries nationally jumping from about 13,000 in the first quarter to over 17,000 in the second quarter and 25,000 in the third quarter? Or is it simply because a $75 increase this year is not as big of a relative change as it was a year ago since the denominator in the rent growth equation keeps getting larger? The answer is likely due partially to all three situations, but the weighting of each factor can vary by market. However, new supply could play an even larger role next year than it will this year.

See the whole report with more charts and data here Continue reading Class C Apartment Building Investments takes the lead in rent growth nationally says Axiometrics.