Good charts on long term returns in this piece from Glenn R Mueller, PhD.:

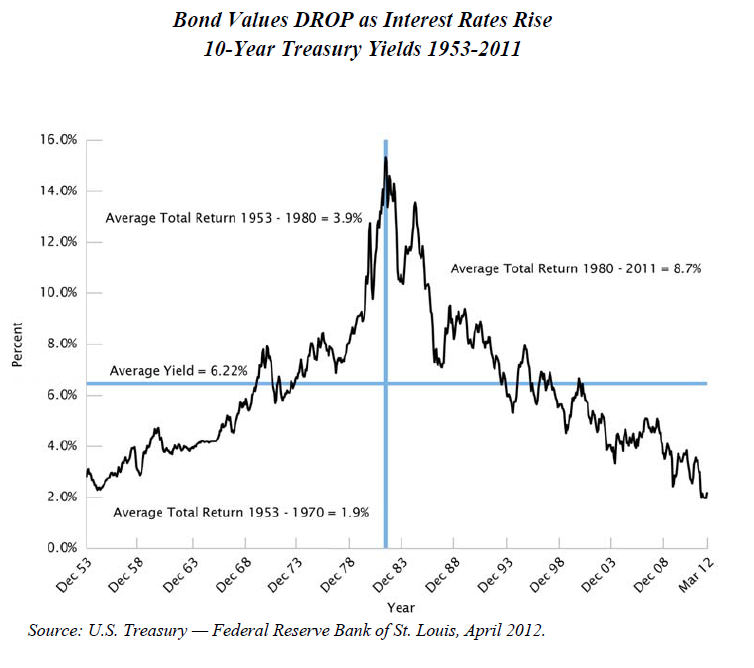

I recently met with my financial advisor to “rebalance” my … retirement portfolio. Based on my “age and stage of life” his allocation model showed a 50% bond allocation. I laughed and asked him if the company allocation model assumed interest rates would rise over the next 10 years? His answer was “yes- of course.” I showed him the graph below which shows lower than average TOTAL returns in a rising interest rate environment and he checked his long-term data and found that bond holders between 1953 and 1980 had actually lost money. We all know that as interest rates rise, bond values decline and thus the total return can be small or negative. Not to mention that a 10-year treasury at 1.5% is below expected inflation and thus a NEGATIVE REAL RETURN. He agreed that a bond allocation did not make much sense, but since my investor profile was conservative what was the alternative?

Dr. Mueller is a real estate guy and one of the pioneering researchers on the real estate investment cycle so you can guess what he thought the answer should be- See his paper linked above for his detailed answer why. One thing to be aware of is that Dr. Mueller’s work at Dividend Capital, a sponsor of non-traded real estate investment trusts (REITs) causes his focus is to be on ‘institutional grade’ properties, typically large newer properties located in primary (very large) markets around the country. These properties typically trade at relatively high prices compared to older or smaller properties, or those in smaller markets. The idea of course is that the returns over time for institutional properties will be steadily increasing at a higher rate to repay the opportunity cost of the higher initial investment.

Because of their size and the amount of capital they must deploy institutions typically only look at apartment buildings with more that 150 0r 200 units. This creates an opportunity for investors and small groups to occupy the niche of properties smaller than institutional size but still large enough to support full-time professional management and leasing. This is the niche where we do a lot of work with our clients, the 65-145 unit range. We find that these properties, except those in the hottest markets, avoid the run-up in prices that occurs in institutionally size properties. That said we also work with many individual clients investing in ‘teen’ apartments between 10 and 20 units as well. To find out how you can add the income and inflation protection of apartment building investment to your retirement portfolio connect with me through our Contact page.