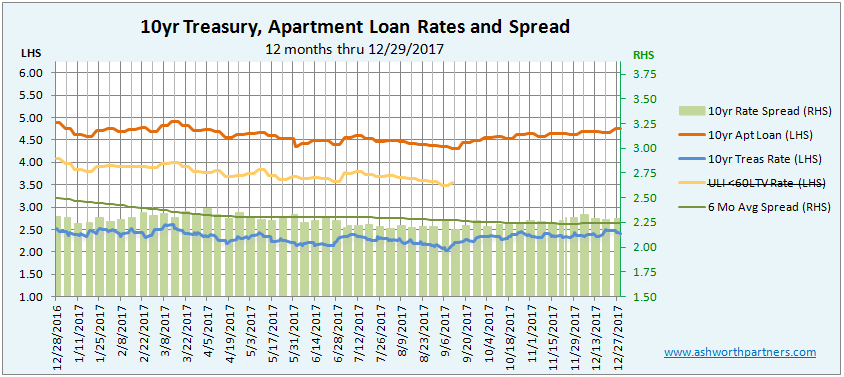

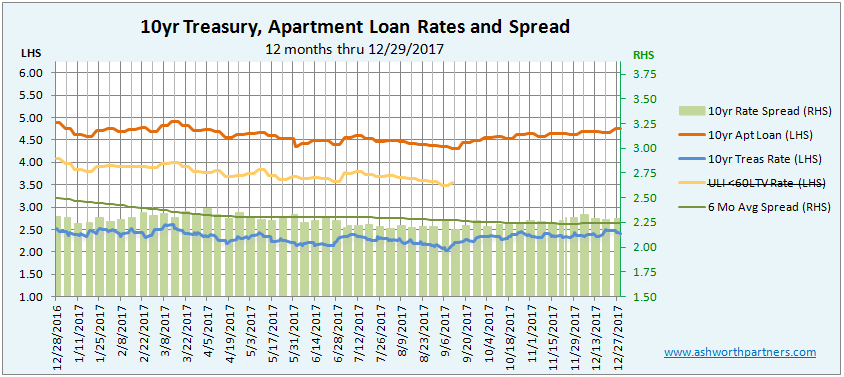

The apartment building investment loan rate we track ended the year 12 basis points (bp) lower than year-end 2016 at 4.76% (see below for details on this loan rate). At the same time the Continue reading Apartment Loan Rate Ends Year Lower Than Last

The apartment building investment loan rate we track ended the year 12 basis points (bp) lower than year-end 2016 at 4.76% (see below for details on this loan rate). At the same time the Continue reading Apartment Loan Rate Ends Year Lower Than Last

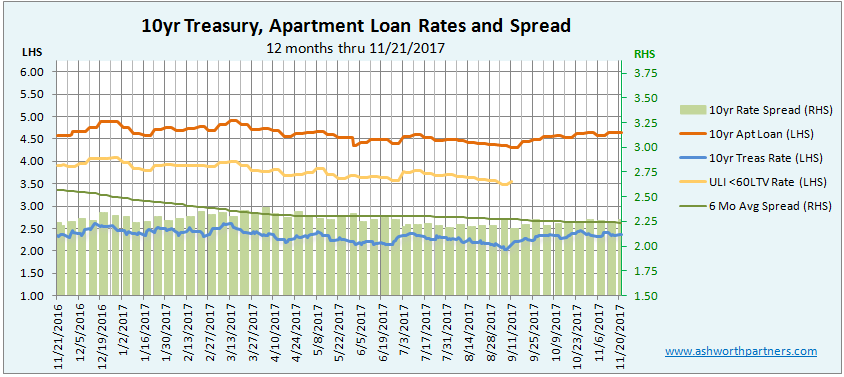

The apartment building investment loan rate we track remains above 4.5% where it has been since the end of September, coming in at 4.64% as of yesterday. The spread between it and the benchmark 10 year Treasury (T10) has widened, but only by 4 basis points (bp) since last month’s report.

Speaking of the T10, a funny thing happened on the way to the forum this month; the curvature of Continue reading Apartment Loan Rate Holds Above 4.5%

First I want to take a moment to remember all those who lost or gave their lives as well as their families and friends that terrible day sixteen years ago. I have four friends who but for their own unique twists of fate would have been in the twin towers on 9/11 and their good fortune is a stark reminder of so many who weren’t that lucky. Also I keep in my thoughts all those who are suffering because of wild fires, hurricanes, floods and earthquakes around the world right now. – Giovanni

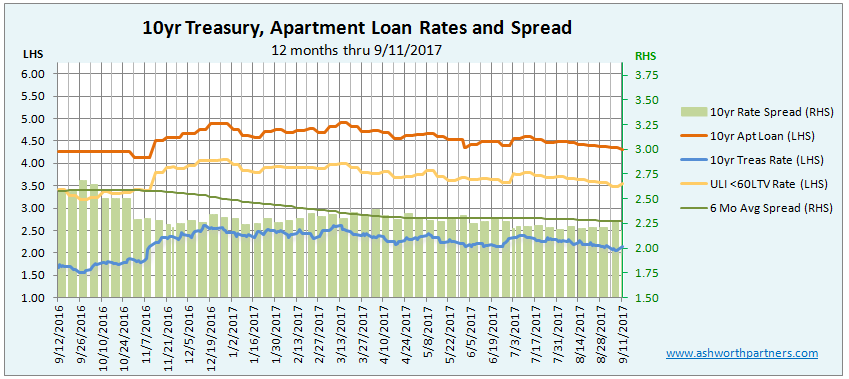

The 10 year apartment investment loan rate we track fell 10 basis points (bp) from last month even though the benchmark 10yr Treasury rate jumped 8bp today to 2.14%. The spread between the two shrank to 218bp, the Continue reading Falling Spread Prevents Apartment Investment Loan From Jumping

Both the 10yr and 15yr apartment building investment loan rates we track fell to lows not seen but for just one week last year and they’ve remained there for five weeks. The 10yr rate dropped 13 basis points to 4.25% and has stayed there since Sept. 14. Likewise the 15yr loan (see below for details on the loans we track) also fell 13bp to 4.375% where it has remained from the middle of September on.

Outside of that one single week last year when Continue reading #Multifamily Loan Rates Find New Lower Floor

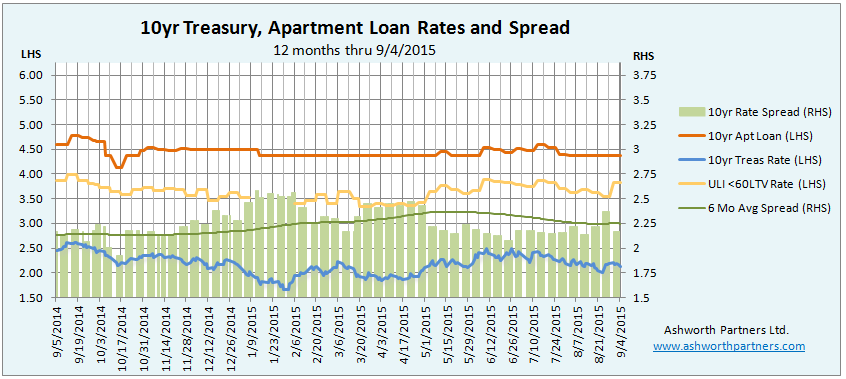

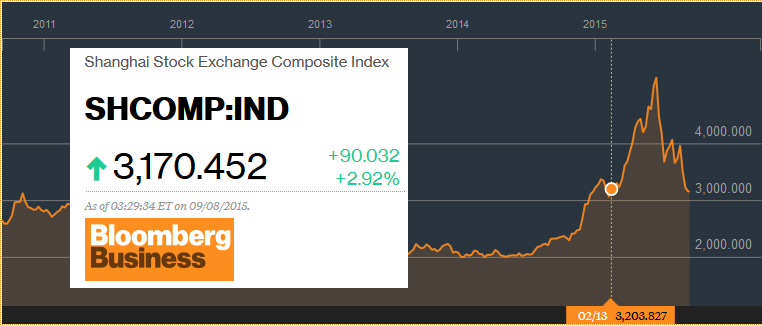

After showing signs of life in June and July the 10yr apartment building investment loan rate we track seems to be fully anesthetized once again and is resting comfortably at 4.375%. Meanwhile the ULI rate seemed to be steadily working its way lower, following the ten year Treasury down which got as low as 2.01%. That all ended with the Chinese stock market melt down and currency devaluation a couple weeks ago and drove the ULI rate up 27bp to 3.82%.

Interestingly despite all the panic about the Continue reading 10yr Apartment Building Loan Rate Back On It’s Meds at 4.375%

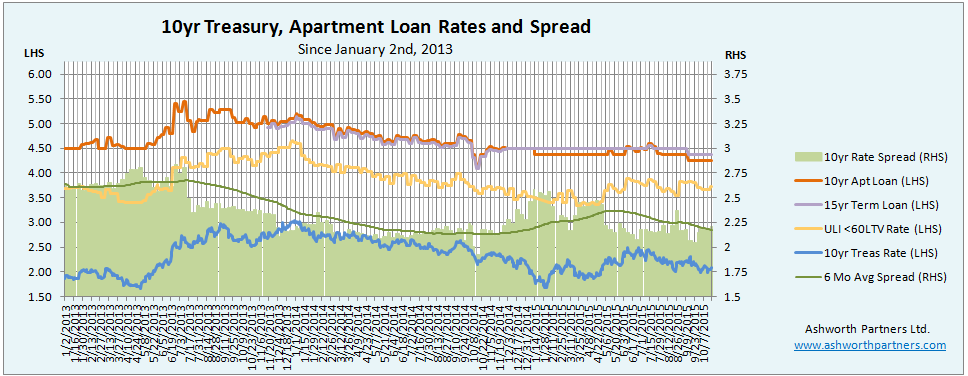

For this month’s post on apartment building investment loan rates and the key 10yr Treasury (T10) we’re looking at the longer trend back to the beginning of 2013. The news has been full of talk about rising interest rates but looking at the chart above we can see that while the T10 is up off its recent low of 1.68% in the end of January it’s still more than 50 basis points below the highs it hit in September and December 2013 (2.98% and 3.04% respectively).

In turn the 10 year apartment loan we track has been treading water around the 4.3% mark for the last nine months and essentially it’s back to where it was in early 2013 before the Continue reading Treasury rates are up but…

The apartment building investment loan rate we track moved down from last week’s 4.532% to just under 4.5 at 4.489% aided by the spread to the 10yr Treasury (T10) compressing to 2.142 versus the week earlier 2.185. Meanwhile the T10 and the ULI rate seem determined to raise rates even if the Fed doesn’t act. And Greece is set to Continue reading Aided by falling spread, apartment loan rate fights its way back below 4.5%.

Are interest rates caught in a Catch-22? What if the Fed is waiting to raise rates until the economy is growing stronger but the economy won’t grow stronger until rates go up?

For three years everyone has ‘known’ that interest rates were going up but other than during the Taper Tantrum of June 2013 which affected loan rates more than Treasuries, the T10 only moved up to the 2.75% area which was just picking itself off the floor of 1.66 where it got down to in May that year.

The Fed would like to raise rates, if for no other reason than to prove they aren’t turning Japanese by leaving rates low for two and a half ‘Lost Decades’. They’d also like to have room to lower them again if the economy dips back into recession (Note Q1 GDP was just revised down to -.7% that’s Continue reading Are Interest Rates Caught in a Catch 22?

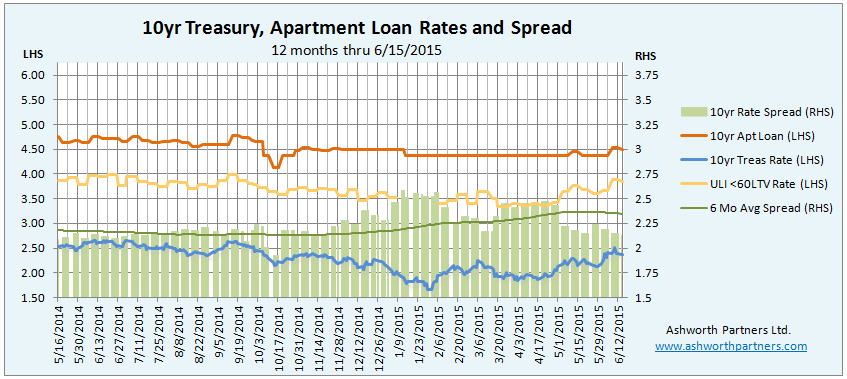

The 10 year apartment building investment loan rate we track moved up to 4.454% from 4.375% yesterday after flatlining at the old rate since the middle of January:

Even so it is still below what we used to think of as the 4.5% floor for this rate. Meanwhile the ULI rate has been tracking the 10yr Treasury, rising from 3.37% April 20th to 3.76% yesterday, a climb of almost 40 basis points.

Is this the beginning of the long anticipated (The 3rd or 4th year in a row that everyone’s known rates were going to rise) rate hikes? It makes sense that the Fed would like them to get up off the floor if for no other reason that they would have room to lower them again when they needed to. But is now the time to do that when China, Europe and the rest of the world are slowing down?

While the US economy has been Continue reading 10yr #Multifamily Investment Loan Rate Comes Back to Life, Rises 7.9 Basis Points

The apartment building investment loan rate we track remains at 4.375% where it landed back in the middle of January. Other than a brief one-week visit to 3.396% back in March which wasn’t even enough to move the chart line it’s been steady as she goes:

With the 10year Treasury dipping below 2% the spread has been widening as 4.375% seems to be the new 4.5%. Once again people are expecting rates to go up later in the year (is this the third or fourth year for that prediction?) but the Fed and the Government have been following the Japanese model step for step and their Ushinawareta Jūnen (Lost Decade) is old enough to drink and will be graduating college soon. I’m not sure why anyone thinks this time will be different just because we’re talking dollars instead of Yen. But there is this:

That men do not learn very much from the lessons of history is the most important of all lessons that history has to teach. – Aldous Huxley

In other news Susan Persin, Senior Director of Research at Trepp has Continue reading Apartment Building Investment Loan Rate Continues Its Steady State