Are interest rates caught in a Catch-22? What if the Fed is waiting to raise rates until the economy is growing stronger but the economy won’t grow stronger until rates go up?

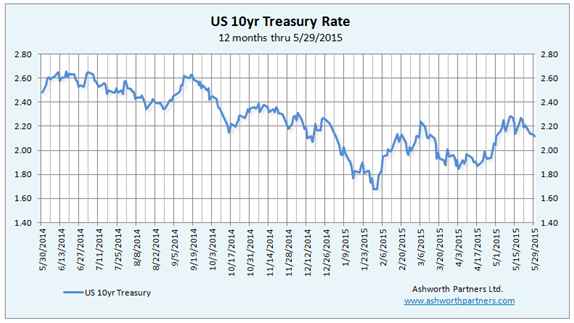

For three years everyone has ‘known’ that interest rates were going up but other than during the Taper Tantrum of June 2013 which affected loan rates more than Treasuries, the T10 only moved up to the 2.75% area which was just picking itself off the floor of 1.66 where it got down to in May that year.

The Fed would like to raise rates, if for no other reason than to prove they aren’t turning Japanese by leaving rates low for two and a half ‘Lost Decades’. They’d also like to have room to lower them again if the economy dips back into recession (Note Q1 GDP was just revised down to -.7% that’s minus point seven) But they don’t want to kill what recovery we do have and the tea leaves don’t portend much good fortune. With the dollar rising (ironically because our Treasuries are paying interest instead of charging interest) imports are becoming less expensive and are putting some pressure on wage growth while at the same time exports are becoming more expensive and therefore less competitive in other markets around the world.

Negative-yield bonds now account for some €1.5 trillion of debt issued by governments in the euro area, equivalent to almost 30% of the total outstanding. Many expect even more of the global bond market to fall into negative yield territory. Half of all government bonds in the world today yield less than 1%. – Mauldin Economics

Meanwhile many of those other markets around the world aren’t doing that hot either. At home companies have squeezed all the blood out of their turnips in terms of efficiency and they’ve financially engineered about as much profit as they can from flattening sales growth so without increasing capital spending (which would reduce CEO bonuses) where’s the growth going to come from?

What’s missing is the traditional sector that leads us out of recession, housing; of the single family kind. Now as a dyed in the wool apartment guy it pains me to say this but with relatively little new housing being built we’re just not going to get the lift we’d usually see in a recovery. Peter Linneman, chief economist over at NAI Global has a very specific reason why that’s not happening: Low Interest Rates.

QE is the most destructive policy for housing in history. It’s not the green fees it’s the club membership. If I don’t have the downpayment it doesn’t matter what the interest rate is. – Dr. Peter Linneman

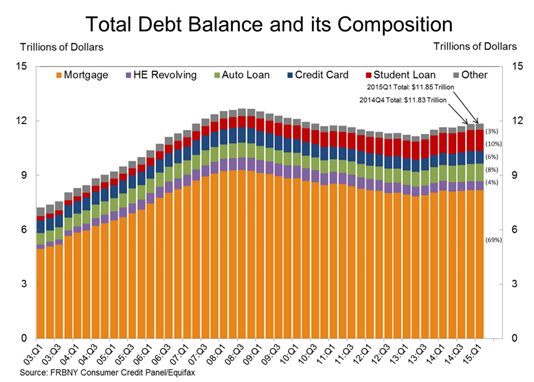

The problem according to Peter is that mom, dad and the grandparents either in or staring at retirement aren’t earning anything on their savings and therefore can’t afford to help out with a down payment. Which leaves Gen Y (at least those who do want to tie themselves to a specific market for thirty years) to try and save up on their own for a down payment… and guess what they’re earning on what they have left after paying on the $1.2Trillion (1.2 with 11 zeros on the end) owed on student loans. The average student loan debt is now about $30,000 so it’s going to be a while before many have a down payment.

This means that those who do own starter homes don’t have buyers to sell to so they can move up and/or buy a new house. In fact according to Zillow’s numbers 56% of mortgage holders for lower tier/starter homes can’t sell their homes and net enough to buy another house at the same price let alone move up to a brand new home. With no new buyers there’s not going to be much moving up soon.

Now for stock market people who’ve seen nothing but up and up since 2009 it’s easy to see why they’re expecting rates to go up but as those of us who toil in the real world know, the stock market ≠ the economy. I’m sure Wall St. people and the talking heads have been feeling pretty good for 6 years now but even as late as last year polls showed 72% of people think we are still in an economic recession and more the half of Main St. Americans still believed we were still in a housing crisis. And that’s the real problem.

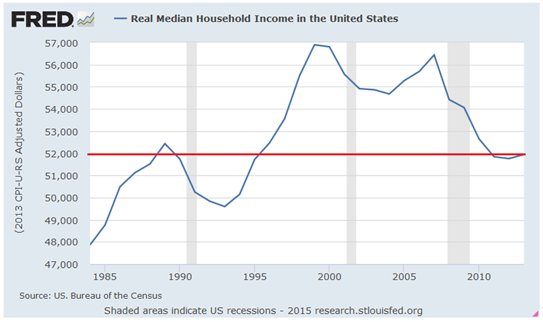

Those Main St. Americans are what drive the economy, which is 70% consumer spending (which may not be a good thing in a flat wages world). If those consumers still aren’t feeling too confident about the economy, or at least their economy, how much consuming will they be doing? As Nick Hanauer explained it in his memo from last summer: The Pitchforks Are Coming… For Us Plutocrats

That person is paying rent, ideally going out to get subsistence groceries at Safeway, and, if really lucky, has a bus pass. But she’s not going out to eat at restaurants. Not browsing for new clothes. Not buying flowers on Mother’s Day. – Nick Hanauer

This is the rub with the Fed being ‘data dependent’, they’re waiting for the economy and particularly now employment and wage numbers to show solid improvement before they normalize interest rates. While entry level, part time and low wage employment has picked up wages haven’t really moved up much and the chart below shows real median income is back to 1995 levels:

Without the typical boost from housing, slowing growth in the rest of the world and/or any growth in real income it’s hard to see how the data will improve enough for the Fed to raise rates more than a token amount. And then there’s this; observers have noted that the Fed rarely raises rates during an election cycle so that if the Fed doesn’t like the data it’s seeing very shortly the first rate hike most likely won’t come until 2017.

What does that mean for real estate investors? Well with the benefit of hindsight we should have been financing deals with short term adjustable rate money in the 3-4% range. Going forward for short term holds (<5-7 years) that might still be a good plan. For long term holds with interest rates below the long term average of 6ish locking a low rate in for as long as possible, 30-35 years even, you will be very happy down the road with the rate and not having to worry about a refinance.