Was talking about this just last week (again):

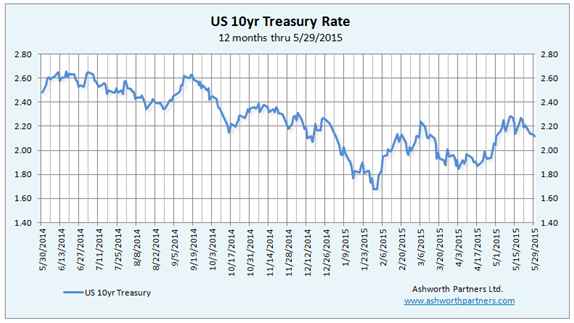

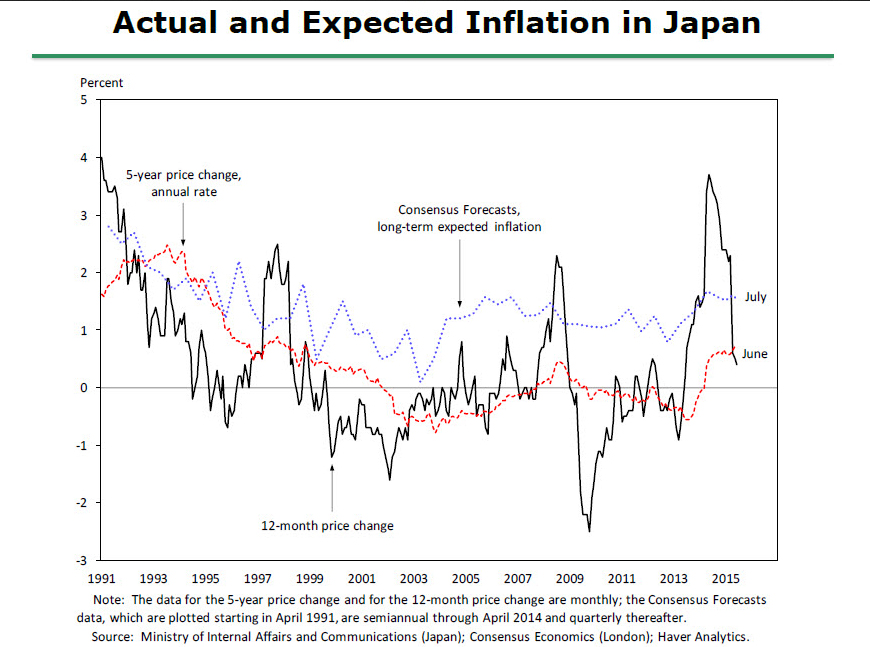

As a value guy like you it’s hard to figure out how buying something in the sixes on cap rate works out to be a good deal. But what if the Fed is trapped at the Zero Lower Bound and we are turning Japanese? Their ‘Lost Decade’ is now old enough to graduate with a Master’s degree and we’re following the exact same playbook. I offer last week’s Fed decision as exhibit #1. They would dearly love to raise rates just to prove they can but there’s just thin ice between us and

Continue reading Fed Chair Yellen- Maybe we are turning Japanese