With today’s stock and bond markets overrun by insiders and the volume of options, futures and other derivatives dwarfing actual investment in good companies while driving wild swings in their prices what is a traditional value investor to do? What about the accounting trickery that happens when CEOs raid their own companies for the short term results their huge bonuses are based on? Should you shrug your shoulders and be patient, very patient hoping eventually value will be recognized? What kind of income will you live on while you are being so patient? With interest rates so low and the Fed trapped into keeping them that way how can you earn decent current income without taking unreasonable or unknowable risks?

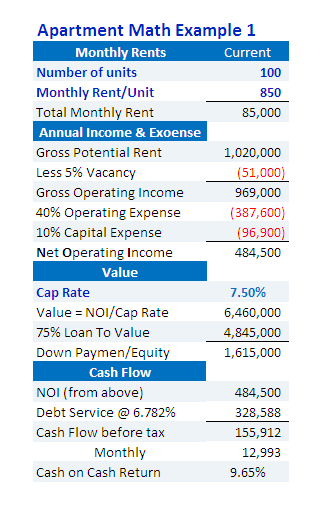

There is an alternative for conservative value investors: Apartment buildings.

- What if you could find good value stocks in a market where the price was dictated by the financial results, not market ‘sentiment’, momentum traders, short sellers, high frequency trading programs or what a butterfly did in Shanghai?

- What if you could find good value stocks in a market where the cycles were observable and understandable?

- What if your favorite value stocks paid annual cash dividends of 7, 8, 9% or higher while at the same time increasing their equity like clockwork?

- What if you could walk into the boardroom of your favorite value stock and dictate that they improve their performance? What if you could fire boardmembers who didn’t perform?

- What if you could buy a second stock with funds from your first stock without having to sell it or pay taxes on the capital gain?

- Plus Inflation Protection: What if the dividend went up when inflation did? Continue reading Apartment Buildings are the classic Value Investment