Recently I’ve been working with several new clients who are conservative investors looking for better returns than CDs and Treasuries but aren’t interested in taking on the volatile market risk of stocks, bonds and derivatives. I was explaining why apartment investments make sense and there are quite a few reasons but the biggest one is how the math of an apartment building investment works. In this post I’d like to share that with you in case you’re also looking for conservative income producing investments with inflation protection and upside potential.

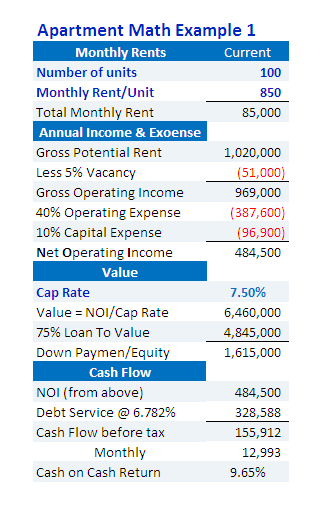

Here’s the numbers on a typical apartment investment:

In this example is a 100 unit building with 850 per month per unit average rents which is purchased with a down payment of 25% and a 30 year loan for the balance at 5.5% interest. Vacancy is 5% of Gross Potential Rent, expenses total 50% of Gross Operating Income and a cap rate of 7.5% is used. Today in some markets cap rates are higher (buildings less expensive) and in a few others cap rates are lower (buildings more expensive).

Apartment Buildings are valued on the income they produce. (This post is about properties larger than 4 units, smaller properties are valued more similarly to single family homes.) There are several ways to calculate the value based on the income but the most common is the capitalization rate, or cap rate for short. The cap rate is the percent of the property value that the Net Operating Income (NOI) represents: Continue reading Why We Like Apartments- Owning them that is.