Recently I’ve been working with several new clients who are conservative investors looking for better returns than CDs and Treasuries but aren’t interested in taking on the volatile market risk of stocks, bonds and derivatives. I was explaining why apartment investments make sense and there are quite a few reasons but the biggest one is how the math of an apartment building investment works. In this post I’d like to share that with you in case you’re also looking for conservative income producing investments with inflation protection and upside potential.

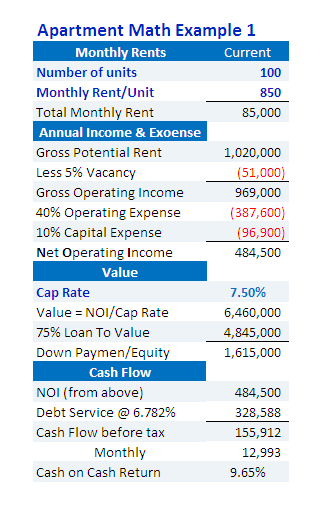

Here’s the numbers on a typical apartment investment:

In this example is a 100 unit building with 850 per month per unit average rents which is purchased with a down payment of 25% and a 30 year loan for the balance at 5.5% interest. Vacancy is 5% of Gross Potential Rent, expenses total 50% of Gross Operating Income and a cap rate of 7.5% is used. Today in some markets cap rates are higher (buildings less expensive) and in a few others cap rates are lower (buildings more expensive).

Apartment Buildings are valued on the income they produce. (This post is about properties larger than 4 units, smaller properties are valued more similarly to single family homes.) There are several ways to calculate the value based on the income but the most common is the capitalization rate, or cap rate for short. The cap rate is the percent of the property value that the Net Operating Income (NOI) represents:

NOI ÷ Property Value = Cap Rate% <-OR-> NOI ÷ Cap Rate% = Property Value

For example a property that generates $10,000 in NOI is worth $133,333 at a cap rate of 7.5% 10,000 ÷ .075 = 133,333.33

NOI is similar to EBITDA in that it is net income before debt service. NOI is used because there are so many different ways to finance a property from all cash to 85% Loan to Value and higher and the cap rate is used to compare buildings and not investments. (I will cover how to compare different investment and financing alternatives in a future post.)

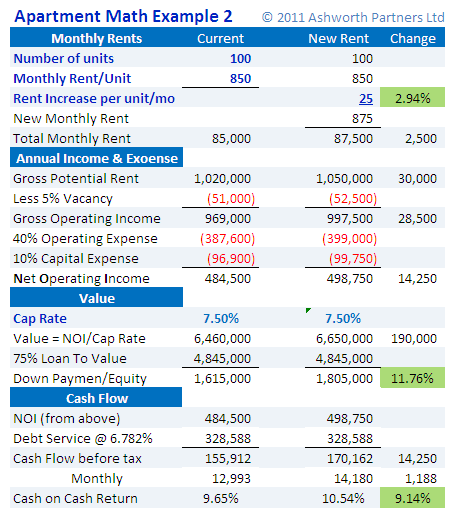

The key point is that an apartment building is worth a multiple of its NOI and that means you can operate an apartment building like any good business, raise rents or control expenses to increase income and the value can go up dramatically. Essentially a 7.5% cap rate is the same as 13x earnings so every extra $1.00 in NOI = $13.33 in value. Let’s raise the rents $25.00 a month in our example and see how that plays out:

Raising rents $25 or about 3% increases the value and owner’s equity $190,000 or almost 12% plus the income goes up more than 9%. That is the power of apartment building investment. Notice that in this example that the building is nearly full, if we were to buy a building that had more vacancies we could have paid a lower price based on the lower Net Operating Income and we would have the opportunity to create even more value by improving the management to bring in more renters. That is why we like apartments.

When I talk about investing in apartments I am not talking about being in the landlord business, I am talking about being in the property owning business and one of the expenses we gladly pay is for professional property management. We’re not in the tenants, toilets and trash business; we hire the pros to handle that and our job is to manage the managers…. And reap the rewards. Find out how we invest in apartments and how you can too by contacting me at giovanni@ashworthpartners.com.

If you would like a free copy of the Apartment Math Example work sheet to explore how the numbers work on different properties send me an email with “Apartment Math Example” in the subject line.

Note that this simplified example does not include any additional income from laundry, parking, application fees, etc. It also doesn’t include any acquisition costs such as commissions, appraisals, loan fees or closing costs. To analyze a potential apartment investment the professional way with the tool we use every day go to our DEALIZER Page.

please send APT Math example thanks for giving valuable info.

Hello Cynthia, please send the request via our Contact page: http://ashworthpartners.com/contact/ with “Apartment Math Example” in the subject line.

Thanks-