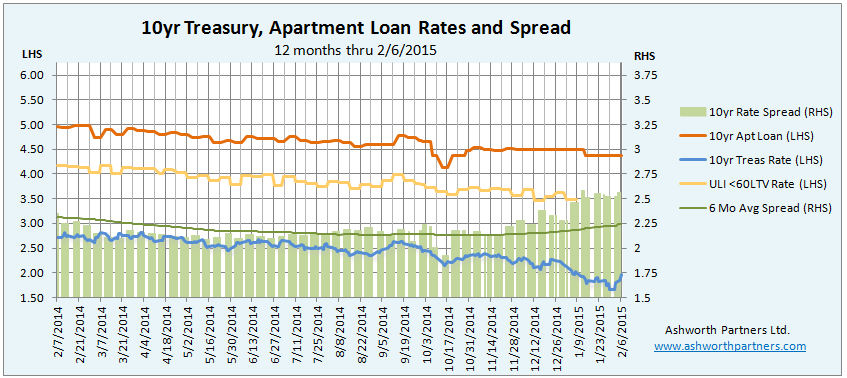

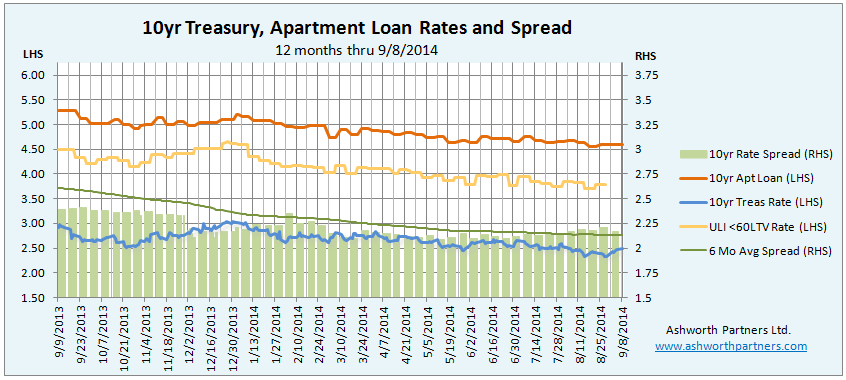

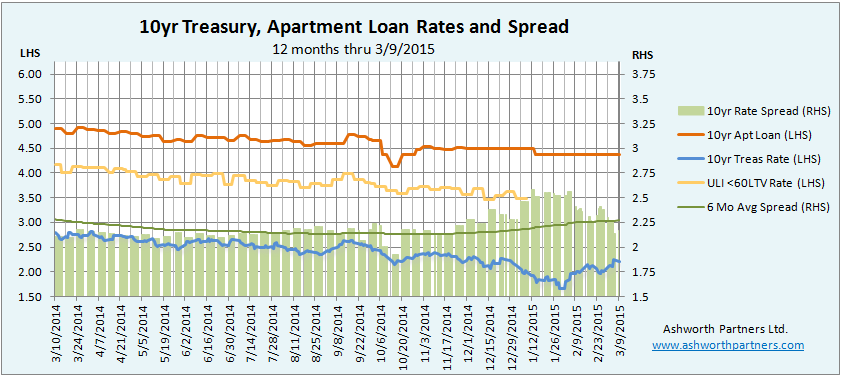

The 10 year fixed rate apartment building investment loan we track fell 6 basis points (bp) to 4.369% today. (See loan details below):

That drop doesn’t show up on the chart very well but it’s the first change in the rate since the middle of January when it had been flatlining at 4.5% since the end of November. Meanwhile the T10 (10yr. Treasury) had been working its way higher since hitting 1.68% in the end of January which in turn has been reducing the spread between the two rates from the 2.5% range down below 2.25% and coming in to 2.169 today. I expect the Continue reading 10 Year Apartment Building Investment Loan Rate Drops Another 6 Basis Points Today