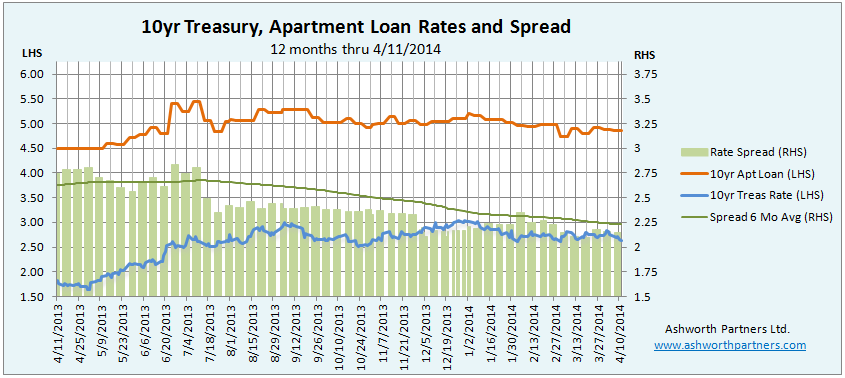

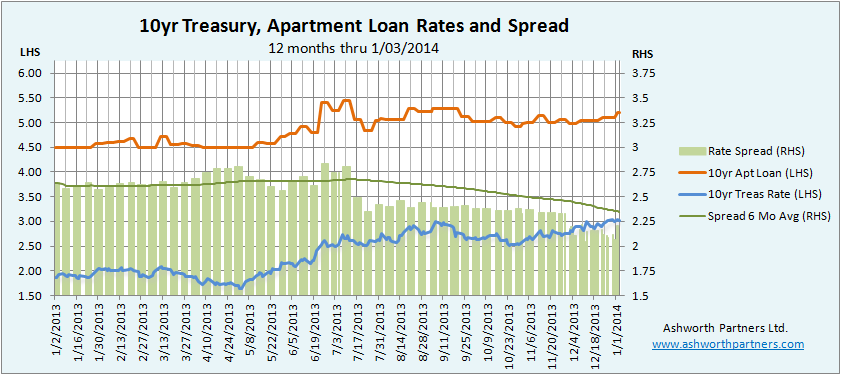

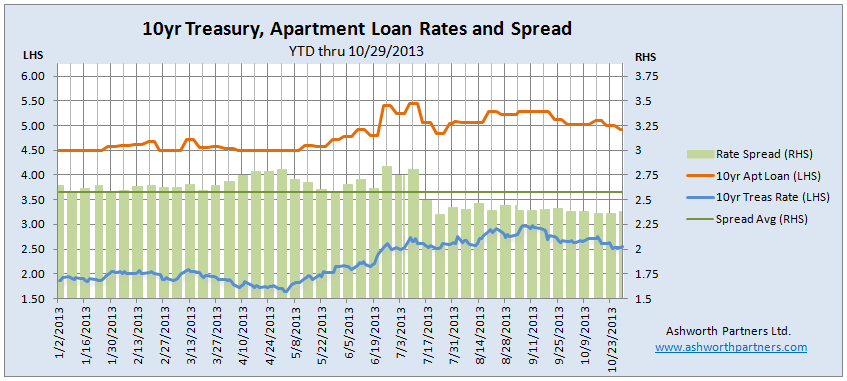

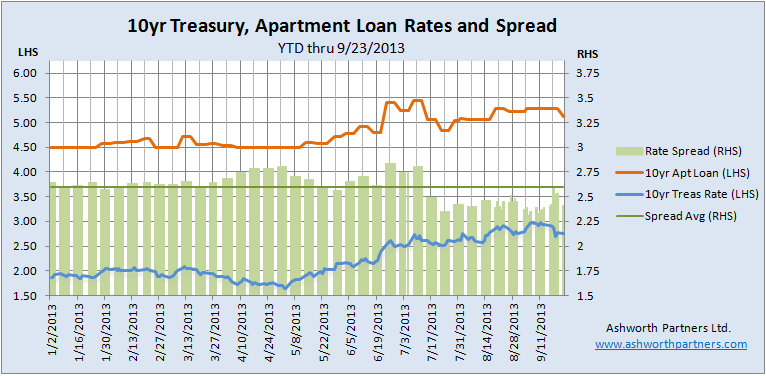

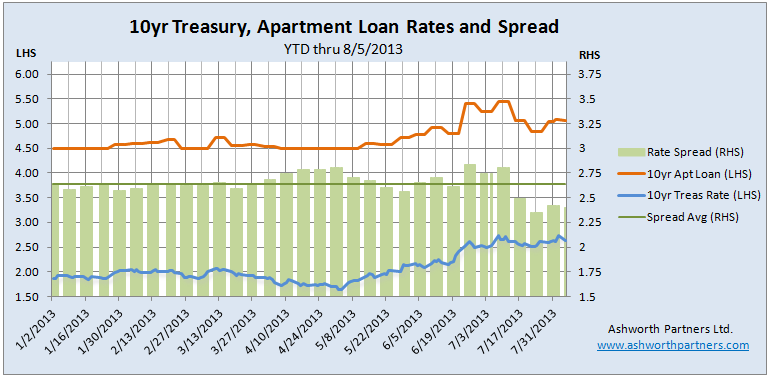

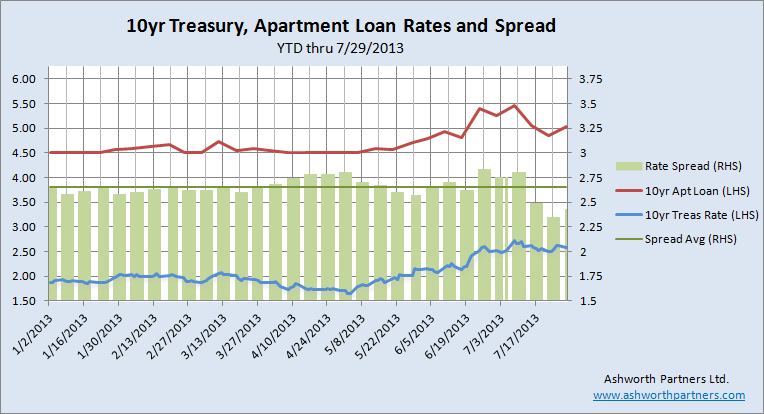

The apartment building investment loan rate we track continued to trend downward as both the 10yr Treasury (T10) and the spread between the two came in during April. Today’s new rate on the loan is 4.733%, a 212 basis point spread over the T10 which was in the 2.61% area today. The six month moving average spread continues to fall suggesting that lenders are more confident and/or aggressive but the spread itself is above the March 17 low of 209bp.

This month we add a new rate which the ULI (Urban Land Institute) reports on from the Trepp survey. According to the ULI the Trepp rate is what large institutional borrowers could expect to pay on a 10 year fixed rate, less than 60% LTV loan for a “crème de la crème” core apartment property located in a gateway market. We track this rate as a barometer of what the largest lenders are offering their best customers on the most secure loans for any advanced warning about future rate and spread changes. See the ULI<60LTV Rate on the chart below (in gold). Note that the spread we chart is between 10yr loan we track (in orange) and the T10 (in blue):

Speaking of the spread between the T10 and the ten year apartment loan rate, now that Continue reading Apartment Building Investment Loan Rate Trends Lower as 10yr Treasury and Spread Fall.