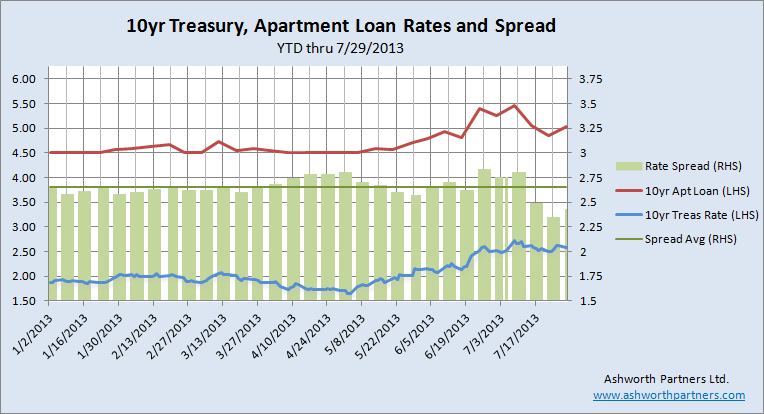

Quick update: The 10 year Treasury (T10) climbed back up into the 2.60% range while the 10 year fixed apartment building loan we track moved up to 5.033%. The spread between them widened to 242bp but remains below the 2013 average of 265bp. This week we’ve added the darker green line to show the average spread between the T10 and the apartment rate on the chart. Note that it uses the Right Hand Scale along with the spread itself:

For details on the apartment loan we track see the notes in last week’s post here: Apartment Building Loan Rates Fall as Spreads Narrow.

How the St. Louis Fed calculates the 10 year Treasury rate displayed above: “Treasury Yield Curve Rates. These rates are commonly referred to as “Constant Maturity Treasury” rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. These market yields are calculated from composites of quotations obtained by the Federal Reserve Bank of New York. The yield values are read from the yield curve at fixed maturities, currently 1, 3 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity. For even more detail see: http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/yieldmethod.aspx

As a reminder, one basis point or 1bp is equal to one-one hundredth of one percent or .0001. When you hear ‘fifty basis points’ that’s one-half of one percent; ‘125bp’ would be 1.25% or a percent and a quarter, sometimes referred to as ‘a point and a quarter’. A bp seems like a tiny number, too fine to make a difference but in the debt world if you can squeak out an extra 20bp on a 100 million dollar deal (like a pool of apartment building loans) that’s $2oo,000.00 in your pocket. To paraphrase Everett Dirksen: “20bp here, 20bp there and pretty soon you’re talking about real money.”