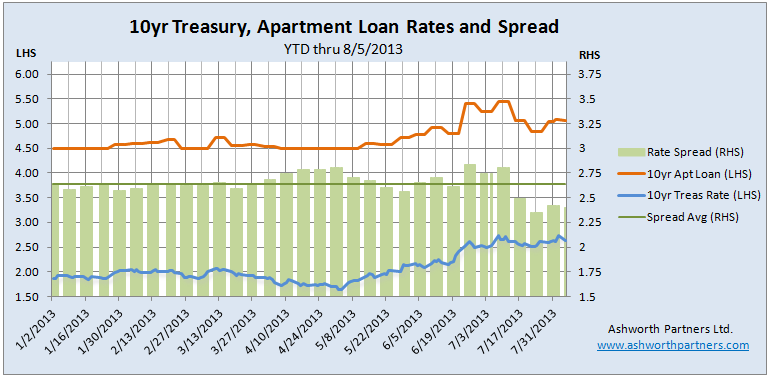

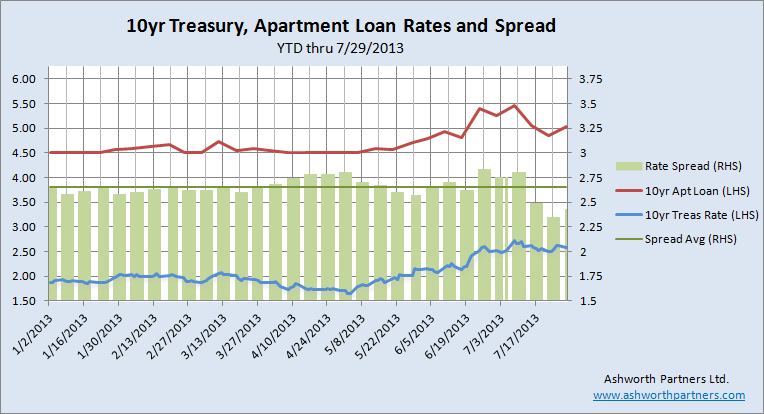

The rate on the 10yr fixed (30yr amortization) apartment building loan we track stayed in the 5.0-5.1% range for the second week while the spread to the 10yr Treasury remained in the 240 area, still lower than the 2013 average of 264:

The narrower spread makes sense in light of the July Senior Loan Officer Opinion Survey on Bank Lending that reported loosening lending standards for commercial real estate loans (including apartments) even as loan demand picked up: Continue reading 10yr fixed apartment loan rate remains below 5.1% as 10yr Treasury ranges in 2.6-2.7% area