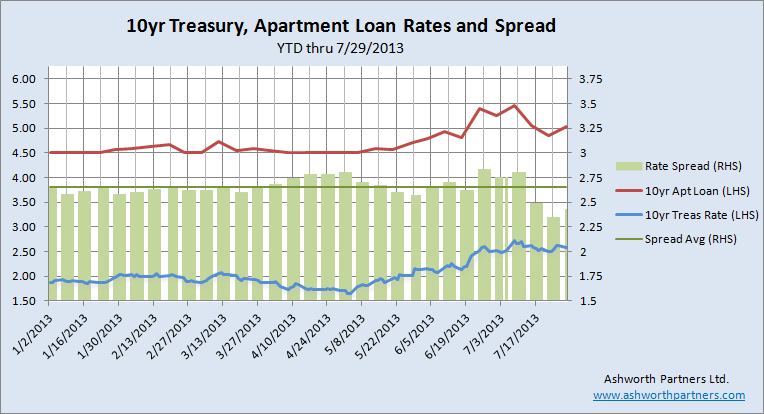

Quick update: The 10 year Treasury (T10) climbed back up into the 2.60% range while the 10 year fixed apartment building loan we track moved up to 5.033%. The spread between them widened to 242bp but remains below the 2013 average of 265bp. This week we’ve added the darker green line to show the average spread between the T10 and the apartment rate on the chart. Note that it uses the Right Hand Scale along with the spread itself:

For details on the apartment loan we track see the notes in last week’s post here: Apartment Building Loan Rates Fall as Spreads Narrow.

How the St. Louis Fed calculates the 10 year Treasury rate displayed above: “Treasury Yield Curve Rates. These rates are Continue reading 10yr Treasury back in 2.6% range bringing apartment loan rates up. The spread also widened but remained below 2013 average.