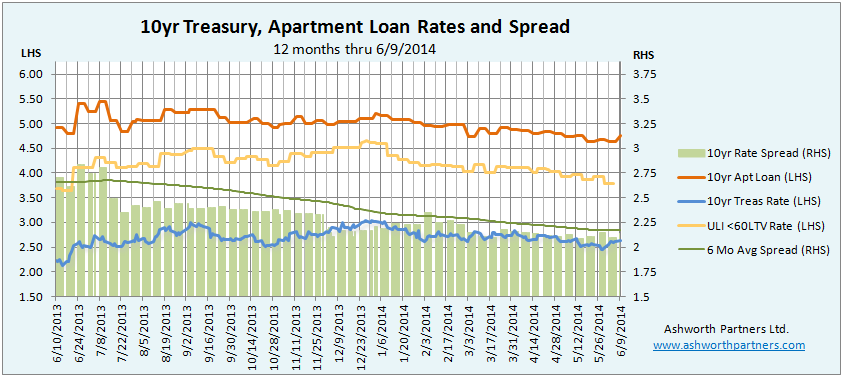

The apartment loan rate we track popped up into the 4.70s today after spending the last three weeks in the 4.60s. Today’s 4.71% rate is about the same as it was a year ago, just before the taper tantrum hit. Monday quotes on the 10 year Treasury have climbed two weeks in a row now but remain below most recent highs of March, clocking in at 2.62 today. The downward march of the spread has flattened recently in the 2.0 – 2.15 range, including today’s number at 2.14. The ULI <60%LTV rate still looks like someone bouncing a ball down the stairs but their data is lagged a week so we’ll have to check back on Friday to see if that rate is going to tick up as well.

Speaking of the spread between the T10 and the ten year apartment loan rate, now that Continue reading Rates For Apartment Building Loans About Where They Were A Year Ago Just Before…