Fannie Mae launched their Energy Star program for apartment building investors by releasing their study on utility use. The report, called Transforming Multifamily Housing: Fannie Mae’s Green Initiative and ENERGY STAR for Multifamily (PDF). It’s loaded with great info on reducing energy and water use as well as stats on use broken up by unit, square foot and region. They also talk about their Green Preservation Plus loans which combined with certified Green Buildings they have financed $130 million in loans on as of Q1 2014. But let’s cut to the chase, key findings [Emphasis mine]:

- On average, a 100,000 square foot property spends $125,000 on energy and $33,000 on water annually.

- If this property saved 15% on energy and water costs, it would increase asset value by almost $400,000, at a 6% cap rate.

- The least efficient properties use over three times as much energy and six times as much water per square foot as the most efficient properties.

- When owners paid for all energy costs, median annual energy use was 26% higher than when tenants paid for them.

- High-rise properties use almost 10% more energy per square foot than low-rise properties

- Properties in the West use almost 50% more water per square foot compared to properties in the Northeast.

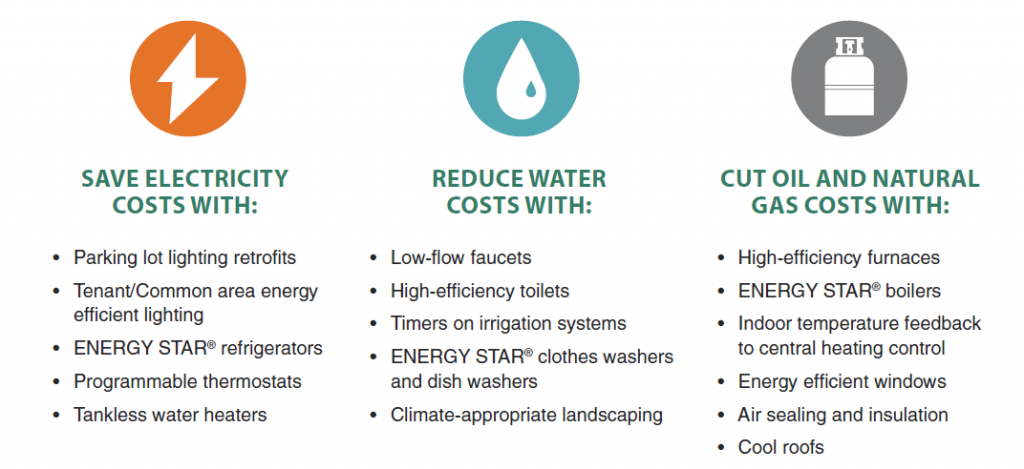

Clearly reducing common area utility costs and getting tenants to pay for their own use are the two of the best ways to improve Net Operating Income (NOI) and they have a nice graphic showing just how to do that:

It’s an interesting finding that buildings in the West use Continue reading Increase NOI at Your Apartment Building with Fannie Mae’s Energy Star Findings