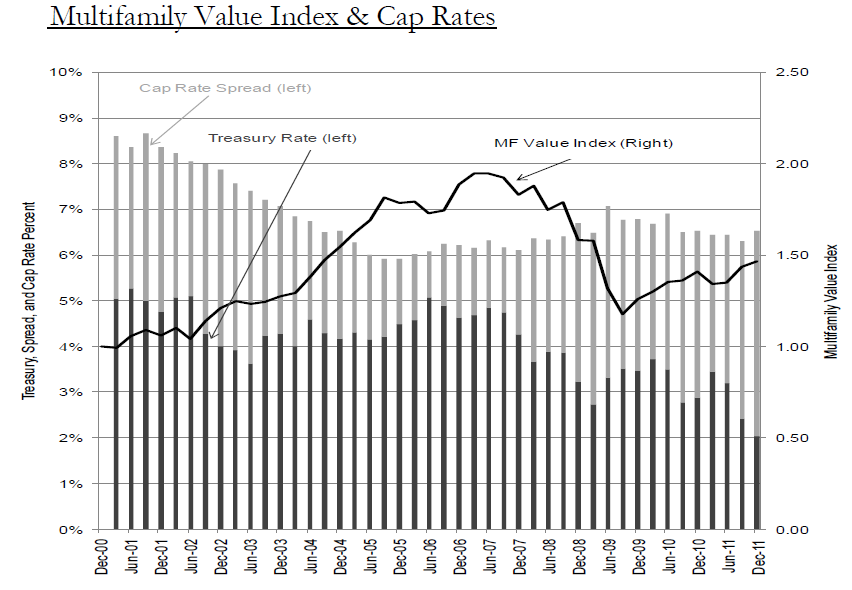

The April 2012 National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions was conducted April 16-23, with 91 CEOs and other senior executives of apartment-related firms nationwide responding.

Capital availability lacks uniformity. Only 17 percent of multifamily firms reported that capital is available for all property types in all markets. By contrast, 36 percent said it is constrained in secondary and tertiary markets and 34 percent said it is constrained for all properties other than top-tier ones – even in primary markets.

The Debt Financing Index declined to 65 from 74. As the only index that dropped below 50 in the past nine quarters (48 in Q4 2010), borrowing conditions continued to improve for the industry. Just four percent believed conditions worsened from last quarter, compared to 34 percent who reported improving conditions.

The Equity Financing Index grew slightly to 62 from 60. One third of respondents reported quarter-to-quarter equity financing as more available, compared to nine percent reporting less availability.

See the excellent exec sum on Joseph Bernard Investment Real Estate’s blog here: Market Conditions Improve For Apartment Industry