Bill McBride over at Calculated Risk stares at this stuff all day and has a pretty good track record reading the Fed’s tea leaves. He believes that actual ‘tapering’ of QE3 purchases most likely won’t start before December although there is a slight possibility that it could happen in September if…..

- 3rd Qtr. GDP rose enough to make 2013 growth look like it will hit the low to mid 2% range.

- Unemployment would have to dip enough to make it likely to get down to 7.2%-ish by year end.

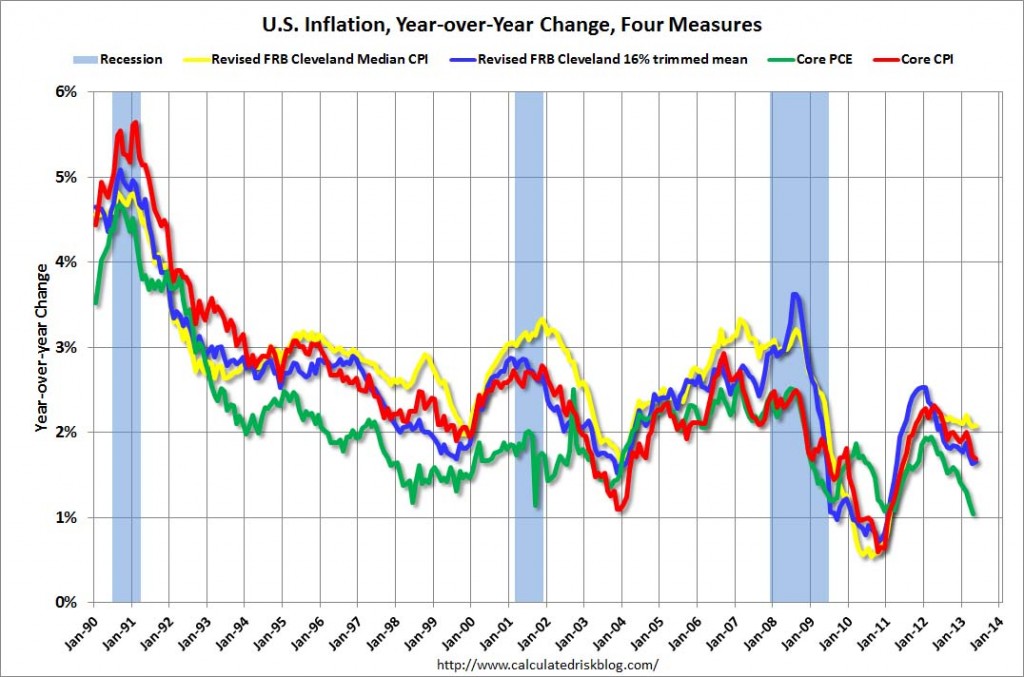

- Inflation has to be increasing. Currently the trend is in the wrong direction and Q1 produced only .3% which is well below the 2% annual the Fed Wants.

See Bill’s analysis here: Analysis on Tapering QE3 I highly recommend following Bill’s blog and this is just one of several posts in the last week on Fed comments around the end of tapering. Here’s the inflation chart he posted last week showing four different measures of inflation, note the trend since the beginning of the year:

Of course none of the Fed’s comments were interpreted this way by bond traders, what they heard was: It’s the end of the world as we know it and we don’t feel fine! (Que a slightly reworded version of the R.E.M. song, the original is here http://bit.ly/10P4OMi if you could use a little blast from 1987. Yeah I know, 26 years ago, can’t believe it either.)

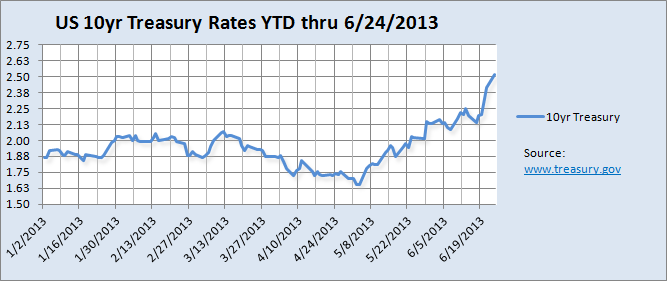

Interest rates on the bellwether 10yr Treasury had been trending up since their recent low of 1.66% on May 1st and week before last were in the 2.2% range. Come Wednesday’s release of the latest statement from Fed and Bernanke’s press briefing which apparently was [mis]interpreted by traders to mean the Fed meant to quit QE3 now and rates went parabolic. They closed today (Monday the 24th) at 2.57%, up 30bp + from a few days ago and nearly a full 1% (100bp) since the beginning of May. Check out the last bit of the chart below to see how vertical the rate has gone in the last week:

So it looks bad but it’s only 1% what difference does that make? Well I am working on an apartment acquisition with a client and we were putting together an offer using the rate sheet I got from one of my lenders Monday which said for a 10 year fixed rate, 30 year loan the interest rate would be 4.93%. When I called the lender Friday to check on availability he said the rate on that loan had jumped to 5.38% or almost a half of 1% in four days! And that’s the ‘sticker rate’ they were advertising, who knows how high the rate will be once the underwriters get a hold of the deal. To use round numbers it means on a $5,000,000 loan that’s an extra fourteen hundred dollars a month in debt service- No bueno.

Now our hope is that it was an over reaction by traders and that calmer heads will prevail but we may have more ‘buy on the rumor and sell on the news’ type action too. When everything is traded (in nanoseconds) on Wall St. we’re at the mercy of people who think a whole trading day is a long term hold and who can’t see any farther than their trading screens.

Eventually cap rates will adjust to the new interest rate environment but they don’t move at nanosecond speed like rates do. In the mean time we are hunting for good properties in good long term markets and we’ll just keep digging.

Last week when Q1 GDP was revised down to 1.8% from 2.4% (that;s quite a revision, the economy grew 25% slower than first thought) Bill McBride repeated his earlier prediction that ‘tapering’ would not start before December, if then. Even to do that the economy, inflation and employment would have to make pretty big steps in the right direction. See Bill’s comments over at Calculated Risk: http://bit.ly/19PFQjM