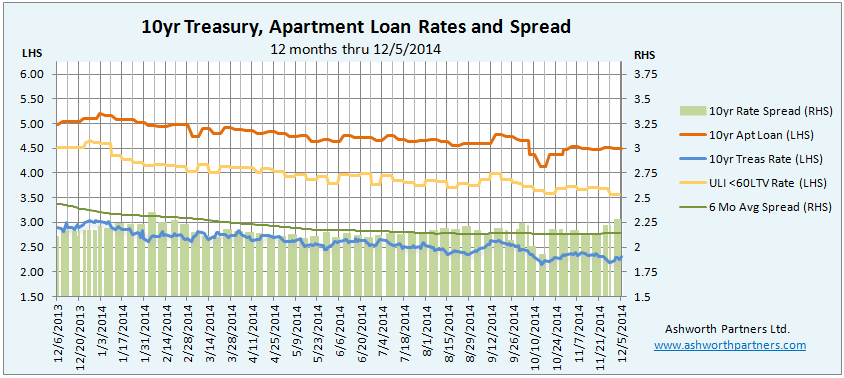

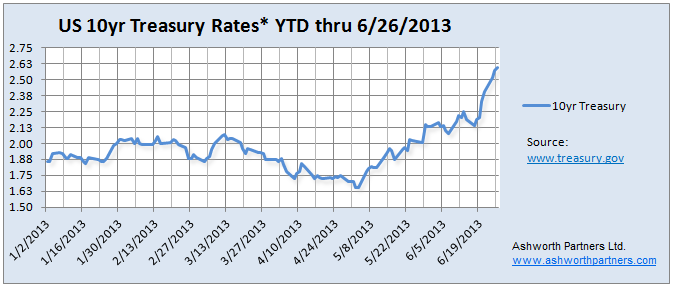

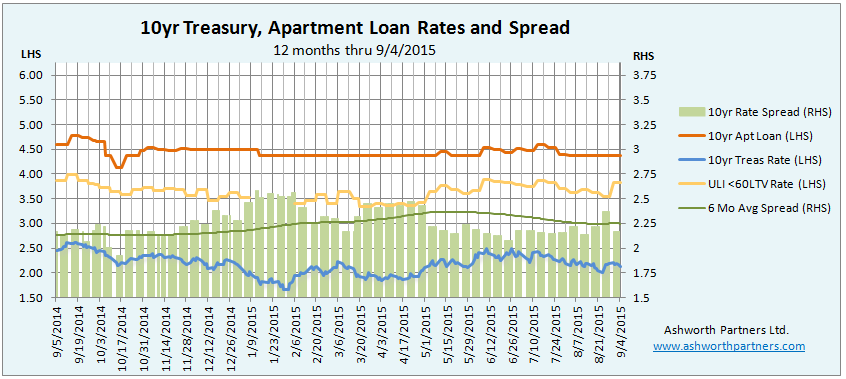

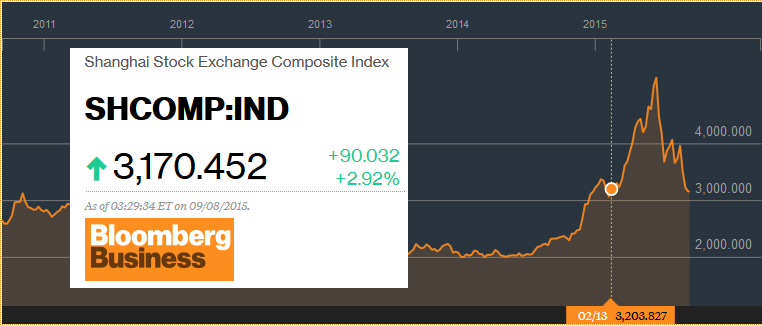

After showing signs of life in June and July the 10yr apartment building investment loan rate we track seems to be fully anesthetized once again and is resting comfortably at 4.375%. Meanwhile the ULI rate seemed to be steadily working its way lower, following the ten year Treasury down which got as low as 2.01%. That all ended with the Chinese stock market melt down and currency devaluation a couple weeks ago and drove the ULI rate up 27bp to 3.82%.

Interestingly despite all the panic about the Continue reading 10yr Apartment Building Loan Rate Back On It’s Meds at 4.375%