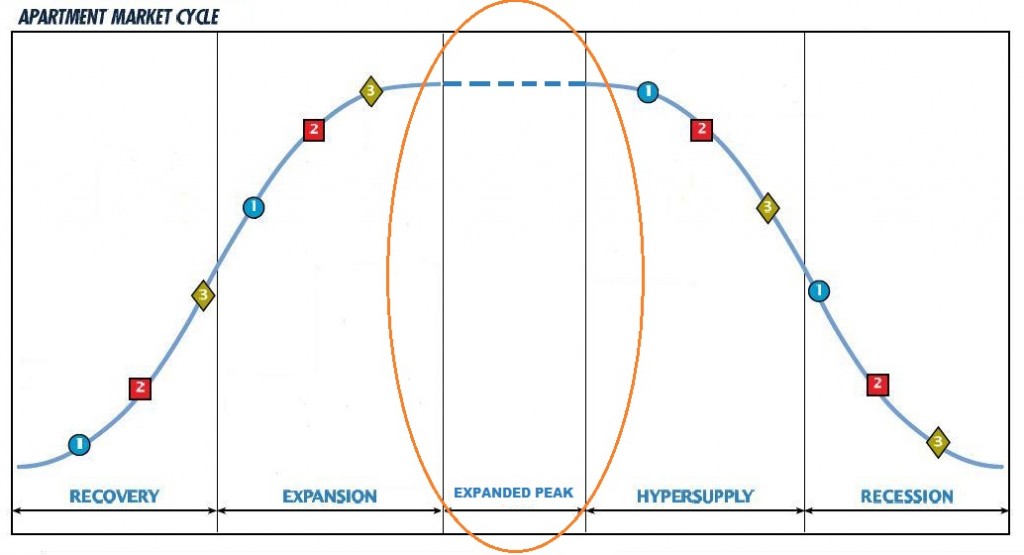

Was quoted in a Multifamily Executive piece this week by Joe Bousquin Cap Rate Limbo: How Low Can They Go? discussing where we are in the apartment building investment cycle, whether multifamily cap rates could go any lower and how do you make a deal pencil in this environment. It’s a good quick read with apartment pros from around the country sharing their thoughts on how things stand. I really got a kick out of the Barbara Gaffen’s story about a Chicago property trading for $651,000 a unit.

Here are the rest of my comments:

The market cycle peak is here, it’s just not evenly distributed. Cycle tops (in the absence of a financial meltdown) tend to be rounded and therefore very hard to call. We’re focused Continue reading UPDATED: The Apartment Market Cycle Peak Is Here, It’s Just Not Evenly Distributed Yet