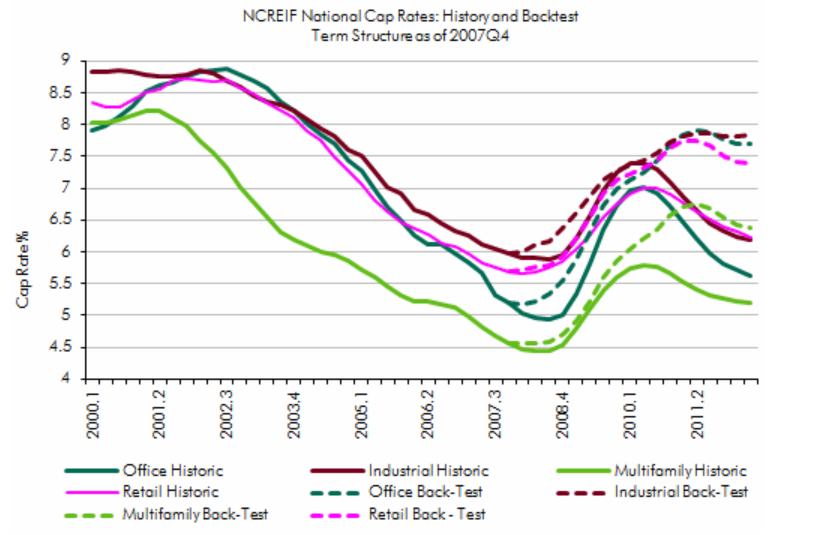

Research out from CBRE Econometric Advisors shows that the typical risk-free benchmark rate, the 10 year Treasury, does not accurately reflect the cost of capital risks in asset pricing for commercial real estate. The whole yield curve or ‘term structure’ should be used instead. Highlights from their report:

- Our research shows that it is not a single risk-free rate that drives asset pricing, but rather the entire term structure of interest rates (also referred to as the shape of the yield curve; we use these terms interchangeably). This term structure effect is so strong that relying upon a single benchmark rate in one’s analysis (as is typically done by analysts and investors) is inappropriate. We will demonstrate this below, using our empirical model of cap rates.

- Secondly, the shape of the yield curve affects investors’ expectations of future interest rates and therefore their investment and pricing decisions. For example, during periods with a flat yield curve, investors may reasonably expect the term structure to revert to its long-run value, with the resulting Continue reading The shape of the entire yield curve drives #CRE pricing, not single Treasury rate- CBRE Econometrics