Research out from CBRE Econometric Advisors shows that the typical risk-free benchmark rate, the 10 year Treasury, does not accurately reflect the cost of capital risks in asset pricing for commercial real estate. The whole yield curve or ‘term structure’ should be used instead. Highlights from their report:

- Our research shows that it is not a single risk-free rate that drives asset pricing, but rather the entire term structure of interest rates (also referred to as the shape of the yield curve; we use these terms interchangeably). This term structure effect is so strong that relying upon a single benchmark rate in one’s analysis (as is typically done by analysts and investors) is inappropriate. We will demonstrate this below, using our empirical model of cap rates.

- Secondly, the shape of the yield curve affects investors’ expectations of future interest rates and therefore their investment and pricing decisions. For example, during periods with a flat yield curve, investors may reasonably expect the term structure to revert to its long-run value, with the resulting steepening of the yield curve (or in case of a steep current yield structure, expect the reverse). The exact effect is complicated, and will depend not only on the terms’ structure but also on current and expected interest rates—which are in turn dependent on the expectations for the economy and monetary policy—but it will exist nonetheless.

- Finally, the term structure represents a truer price signal in the capital markets, which are characterized by demand for and supply of capital under a wide variety of terms. A single rate will capture only a small portion of the underlying prices.

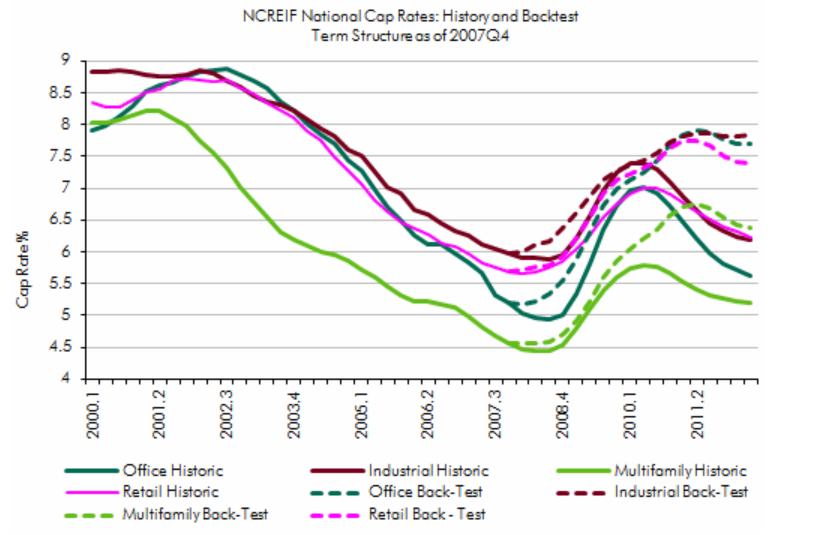

- This finding implies that for the 2008Q1-2012Q2 period, the flattening of the term structure alone has, on average, kept cap rates lower by about 100 bps. This is an extremely significant effect. Furthermore, this econometric experiment demonstrates the tremendous effect that Fed monetary policy—in the form of QE1, QE2, and more importantly, Operation Twist—has had on asset pricing. As can be seen from our analysis, this policy has played an important role (albeit not an exclusive one) in keeping cap rates down.

- The bottom line of this analysis, however, is that it shows the crucial role that the term structure plays in asset pricing. One benchmark rate simply does not reflect true interest rate dynamics and their effects on pricing, and to rely upon a single rate will undermine one’s analysis. When analyzing the effects of interest rates on asset pricing, or when devising an investment strategy, it is important to keep in mind that it is the entire term’s structure that determines matters.