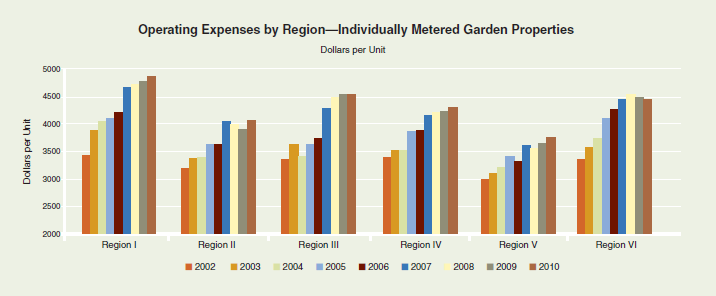

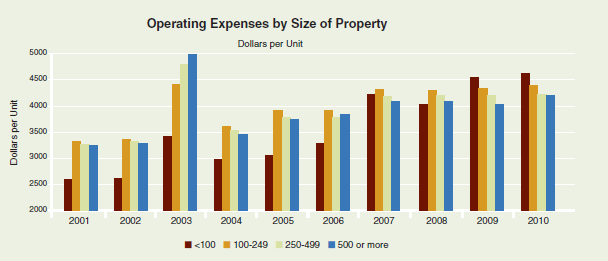

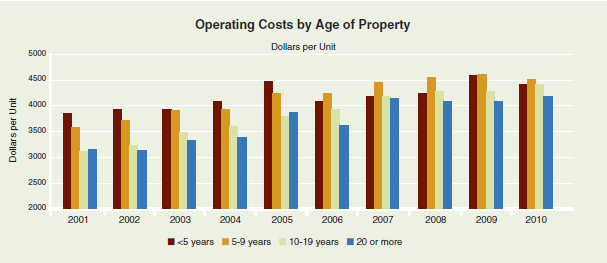

Mike in Milwaukee, WI, that is a great question. Answer: $3,000- 5,000/unit/year. How’s that for an accurate but relatively useless answer? The real question is what is the annual expense per unit of the property you are looking at? If you are a large institutional investor like a REIT looking at national or regional averages like those published in the NAA Annual Survey (See the included charts for results from the 2011 survey) can give you an indication but you can bet the institutional players know their own costs to the penny.

In most larger metros there are also companies who collect and publish apartment surveys showing the areas average rents, occupancy, expenses, etc. One thing to make sure of is that the survey is based on properties similar to yours. There are a number of national companies doing multifamily research but they tend to focus on institutional sized properties 100 units and up so their numbers wouldn’t be comparable for a smaller property. For instance the average property in the NAA survey has about 250 units.

The most important number is the actual cost of operating your property plus setting aside enough for big repairs and improvements. Technically things like replacing the roof, heating system or the windows are capital expenses and not operating expenses but for the purpose of figuring the cash flow (the first and most important measure of the investment) I include the income set aside for Replacement Reserves in the operating expenses. For that I use a minimum of $250/unit/year and have gone as high as $500. Typically $250 is also the minimum per unit Replacement Reserve that banks will use when underwriting your loan so to figure anything less will make financing harder to get- or the property and cash flow will suffer when you do get it financed.

To get the actual expenses of your prospective investment ask for the property’s ’12 trailer’ which is the income and expenses by month for the last year (trailing 12 months). Two years of monthly income and expenses is even better if you can get them. Also get the most recent IRS Schedule E for the property to verify that the current owner is actually spending as much as he claims on the 12 trailer. I don’t think too many people ever under reports their expenses to the IRS so it’s a pretty good cross check.

Sometimes on smaller properties owners only put these together at tax time and so the previous year’s income and expenses is the most current data they have. In that case I would take that and have them give you the month by month inc. & exp. year to date for the current year (Definitely set up a budget every year and then track the income and expenses against the budget every month to make sure there were no surprises once you take over).

The next piece in figuring what the expenses could and should be is to have the property management companies you are considering for the property inspect the property and put together a proposed budget. This way you will have the benefit of professional experience, local knowledge and their estimate of your properties condition working for you in figuring the expenses. Plus this is a very good way to get a sense of what working with them will be like.

One final thing I would do to get comfortable with the expenses is to contact your local Landlord or Apartment Owners Association. They typically have info available or links to providers of those surveys and reports. In addition they can help you actually reduce your expenses with member discounts from recommended providers.

OK, that’s a long answer that probably leads to many more questions, what do you think?

The system is not allowing me to purchase the Dealizer

Tony, thanks for the heads up. Our website people are on it. We’ll get it repaired as quickly as possible. By separate email I’ve sent an alternative for your purchase. Sorry for the inconvenience.