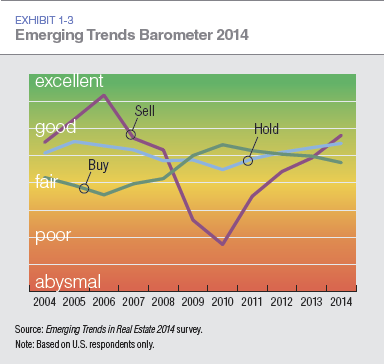

The Urban Land Institute/PriceWaterhouseCoopers annual report on Emerging Trends for Real Estate 2014 was released last week and apartment building investors and commercial real estate pros have some good things to look forward to next year. Note that this post refers to the Americas version of the report with separate sections on Canadian and Latin American markets but they also publish Asia-Pacific and European editions as well. This is the 35th edition of the report is it’s based on individual interviews or surveys from more than 1,000 investors, fund managers, developers, property companies, lenders, brokers, advisers, and consultants.

Here are the 5 key trends we should all be aware of with my comments:

- Survey participants continue to rank private direct real estate investment as having the best investment prospects. Pretty expected from this group but the National Council of Real Estate Investment Fiduciaries (NCREIF) recently released its property performance index for the third quarter of 2013 and on a trailing 12-month basis, the index’s return was 11.0 percent, split about 50/50 between income and appreciation. A pretty nice return compared to fixed income rates and a much safer looking bet than buying equities at their all time highs.

- Dependence on cap rate compression to drive value is being replaced by an emphasis on asset management. Especially in the 24 hour gateway markets apartment building cap rates are about as low as they can get (well until you look at Vancouver BC) so property performance has to come from actually making the property perform. You also have the problem of what to do with your proceeds if you do sell, as you would be reinvesting right back into the same cap rate market that you sold in… unless you changed to a higher cap rate sector, suburban strip centers anyone?

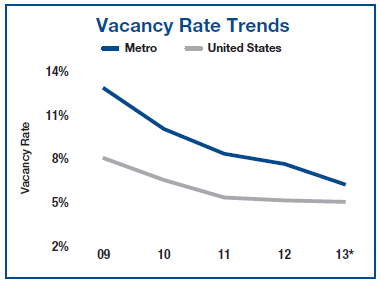

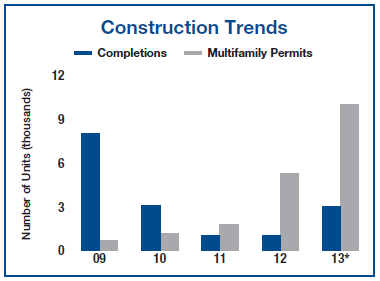

- Opportunities to develop property are finally appearing in sectors other than multifamily. CBRE Econometrics had a piece out last week showing that large (> 350k sf) warehouse properties are being snapped up as fast as they’re being built. Maybe developers who moved over to doing apartments the last few years will move back to their home sectors and ease off on the new supply of multifamily units.

- Value-added investment ranked highest in terms of investment strategy; distressed properties and distressed debt ranked last. We were licking our chops a few years ago waiting for RTC 2.0 fire sales to begin and while we were able take down some bank owned inventory, the anticipated tsunami of defaults on commercial loans never materialized. At this point most everything has been extended and pretended into performing status or sold off and so it’s back to making money the old fashion way: Finding and/or creating value.

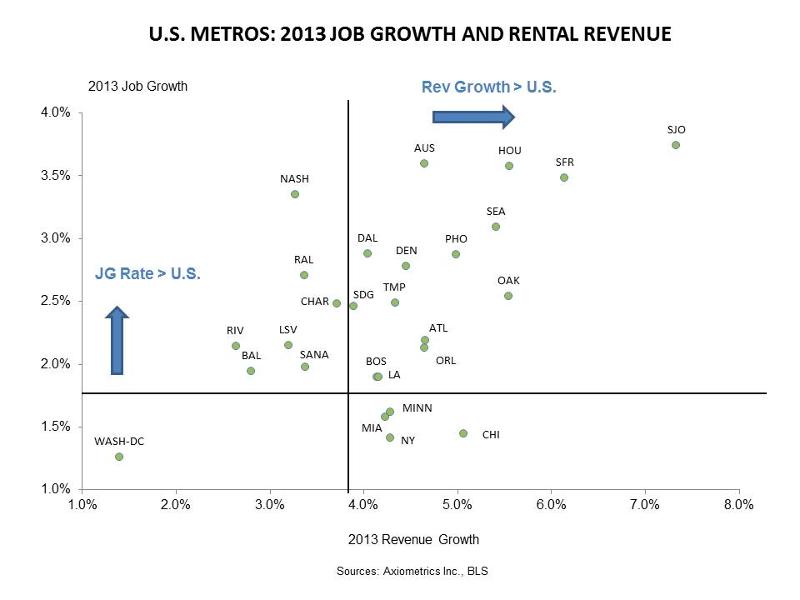

- Both equity investors and lenders are widening their search for business to include secondary markets and niche property types. This will be a double edged sword for investors who are focused on those secondary and tertiary markets as debt financing will be more available but there will also be more competition from sophisticated outsiders with deep pockets. The key will be to make them your buyers so dig in, find the right properties and tie them up quickly.

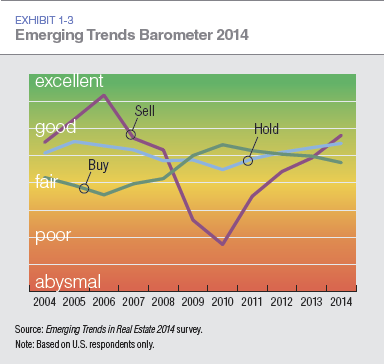

As always with real estate, sectors and markets are so distinct from one another it’s almost pointless to generalize as the chart above attempts to do so next week I’ll dive into the apartment sector to see what gems they’ve unearthed. Meanwhile for the Continue reading 5 Key Trends from the ULI Report for Apartment Building Investors and Commercial Real Estate Pros