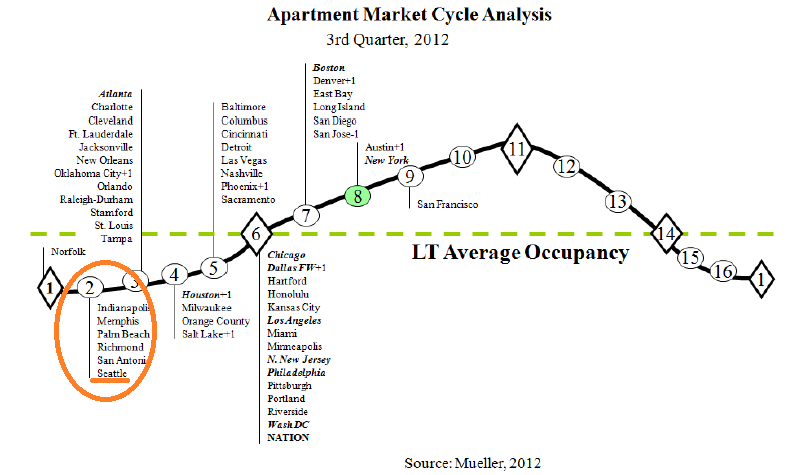

Dividend Capital’s Q3 Market Cycle Monitor Report is out and naturally I looked at the apartment building investment cycle chart first. Specifically these days I’m looking to see where the author, Glenn R. Mueller Ph.D. has placed the Seattle market in the cycle.

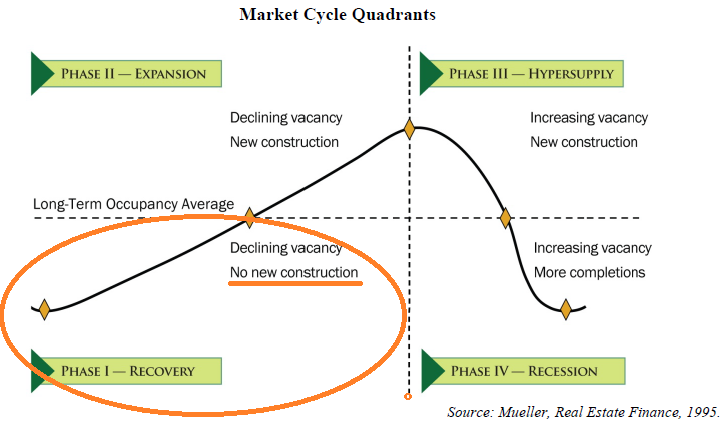

In this latest report you can see that it is listed at position 2 with only Norfolk listed lower at position 1. What does position 2 signify? According to the good Doctor, position 2 lies in the Phase 1 – Recovery Quadrant defined as having “No New Construction” and position 2 specifically having “Negative Rental Growth”. But how can this be?

Dr. Mueller’s methodology is included at the top of every Market Cycle Monitor report and was published as part of his testimony before the Subcommittee on Financial Institutions and Consumer Credit Of the Committee on Financial Services United States House of Representatives on September 14, 2006 on page 14 (here). I have no problem with his methodology in fact it is one of the best technical explanations of how cycles work in real estate to date. The issue however is what data was used to locate Seattle apartments in the cycle.

Depending on whose numbers you read there are between 20,000 and 36,000 new apartment units being delivered this year, currently under construction or in the pipeline and scheduled to be delivered in the next four years in Seattle. The numbers vary depending on whether you are looking at the broader Seattle MSA, the city proper or just the Downtown, Belltown, Capital Hill, South Lake Union and lower Queen Anne neighborhoods which are considered Seattle’s urban core submarkets.

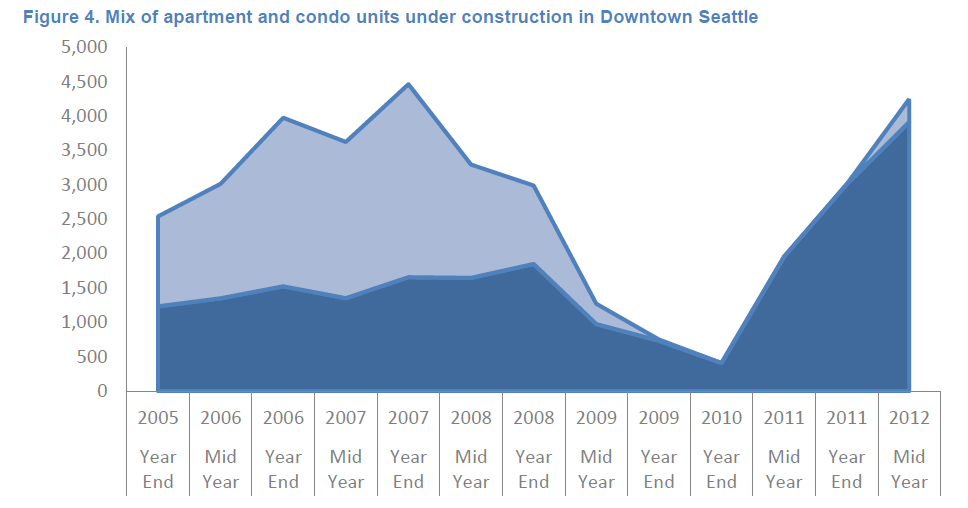

Looking at just Seattle’ urban core area here’s what was under construction as of June according to the Downtown Seattle Association:

Apartment construction has intensified recently. At the end of 2010, three apartment projects were under construction in Downtown Seattle. By the end of 2011, 17 projects were under construction. Fifteen apartment projects broke ground in 2011 alone. Six months later, in June of 2012, 20 apartment projects were under construction. Since 2010, the number of apartment units under construction increased from 409 to 3,916, with 906 more units under construction just since the end of 2011.

In total, as of June 2012, there are 4,104 apartment units either under construction (3,916 units) or permitted for construction (188 units).

These numbers do not include projects that are proposed but waiting on construction permits. Typically a large number of proposed projects do not become formally permitted or are delayed, sometimes for several years. However, it is interesting to note that nearly 11,000 apartment units are currently proposed and unpermitted. This is nearly double the average number of proposed apartment units in any given year. For comparison, approximately 6,000 apartment units and 2,800 condo units have been delivered Downtown since tracking began in 2005. [Emphasis mine]

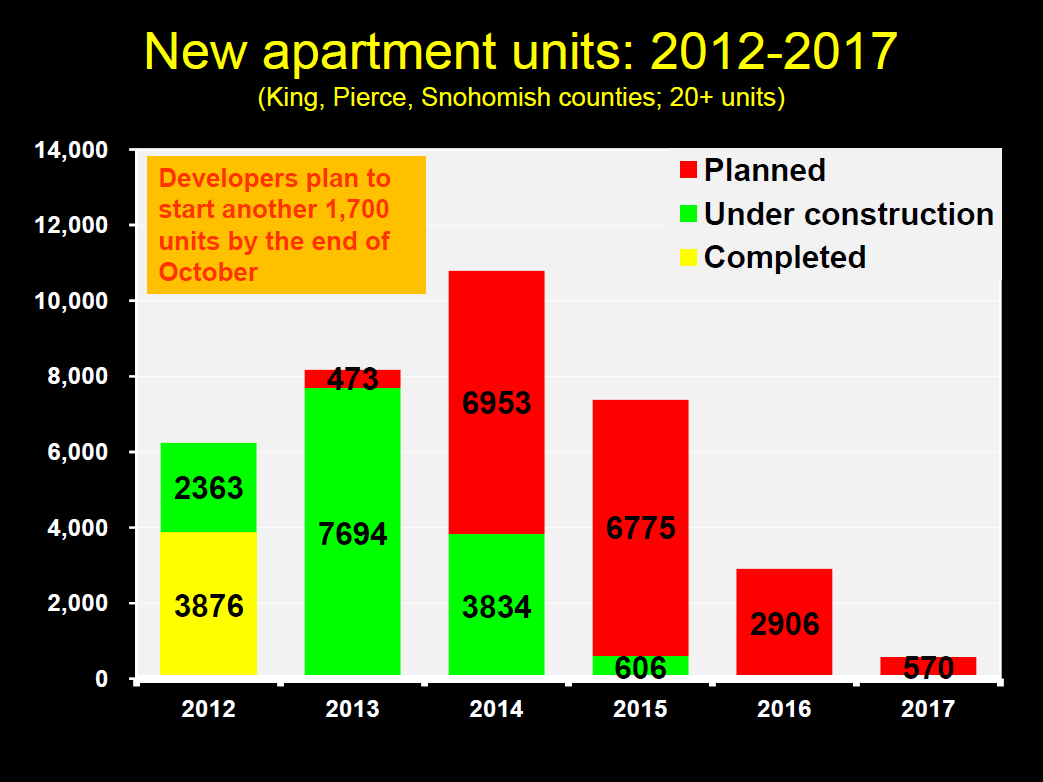

When the view is expanded to the broader Seattle area here’s what apartment market research firm Dupre + Scott presented at the Washington State Apartment Outlook Conference on September 28, 2012:

As of September 2012 there were 14,497 units under construction. Add the 3,876 units just completed this year and you have a total of 18,373 units which is 8.4% of the 220,000 units in the market as of year end 2011.

So whichever slice of Seattle one is looking at no one can say there’s “No New Construction”. What about “Negative Rent Growth”? Lets have a look:

The King-Central area is Seattle from about I-90 north to NE 85th so it includes the urban core and the close- in neighborhoods. Whether one is looking at just core Seattle or the wider area rent clearly turned up in 2010.

According to Kidder Matthews in their Q2 2012 Seattle Apartment Review: “Over the past 24 months, the percentage of property managers anticipating increasing rent increased from 19.1% to 68.6% of those surveyed. At the same time, those properties offering concessions decreased from 60.2% to 25.7%.”

In October Real Facts reported that Seattle was in a tie for having the seventh fastest apartment rent growth in the nation with 6.2%.

Clearly Seattle is in the middle of an apartment construction boom, has been experiencing significant rent growth and therefore has been misplaced in the Dividend Capital Market Cycle. Based on the data I’m seeing it is at the least in the latter half of the Expansion Phase (Position 9 or 10) and could be getting close to the Hypersupply Phase. This is not new news either as I’ve been posting about since early this year (See here, here, here, here, here, here for instance). In fact last May the NNHC said the Seattle market was one of three in danger of OVERBUILDING. The bigger question is what other apartment markets (or even whole sectors) are misplaced? Have a look at where your market is listed and let us know what you find-