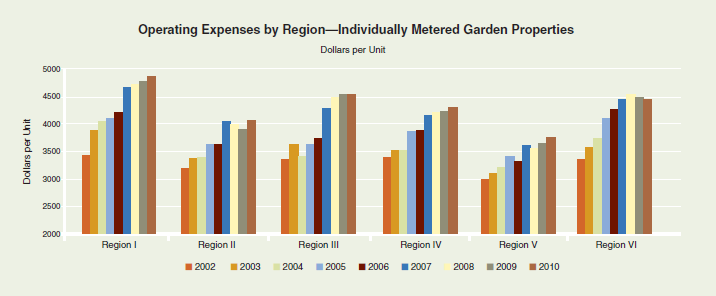

Mike in Milwaukee, WI, that is a great question. Answer: $3,000- 5,000/unit/year. How’s that for an accurate but relatively useless answer? The real question is what is the annual expense per unit of the property you are looking at? If you are a large institutional investor like a REIT looking at national or regional averages like those published in the NAA Annual Survey (See the included charts for results from the 2011 survey) can give you an indication but you can bet the institutional players know their own costs to the penny.

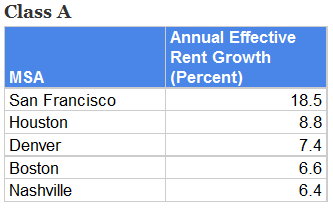

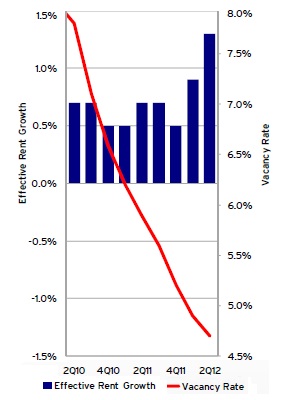

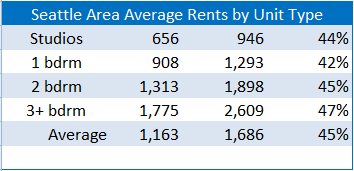

In most larger metros there are also companies who collect and publish apartment surveys showing the areas average rents, occupancy, expenses, etc. One thing to make sure of is that the survey is based on properties similar to yours. There are a number of national companies doing multifamily research but they tend to focus on institutional sized properties 100 units and up so their numbers wouldn’t be comparable for a smaller property. For instance the average property in the NAA survey has about 250 units.

The most important number is the actual Continue reading What is the average annual per unit expense for an apartment building investment? Great reader question answered.