10 year apartment building loan rates had been in a range the last few weeks until Ben Bernanke ‘failed to taper’ last Wednesday causing the bellwether 10 Year Treasury to fall about a dozen basis points to today’s quote of 2.72%. This is good news for apartment building investors, home buyers and builders, stock market speculators, just about everyone except savers, retirees and the people running retirement plans. The upside is that loan rates may head lower but the downside is the economy and particularly employment haven’t improved enough to ease off the money printing pedal.

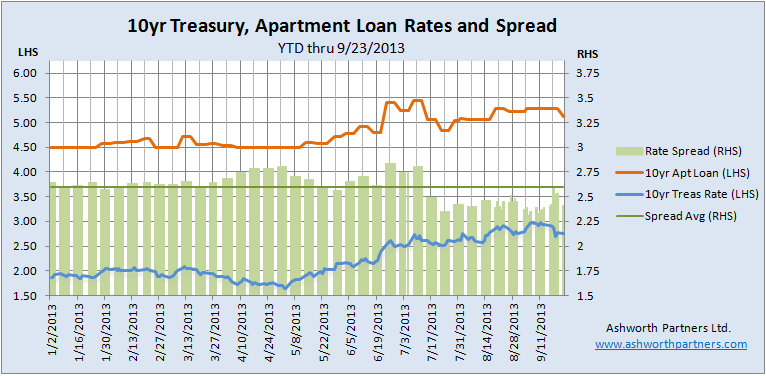

Here’s the latest chart showing the T10, the 10 year fixed apartment rate we track and the spread between the two:

This week’s quote for a 10 year fixed rate, 30 year amortization apartment loan is 5.131%. (See below for more detail on this loan). The other thing noticeable on the chart is that the spread between the rates has been below the yearly average consistently since the beginning of July. In fact the average spread has fallen to 2.602 from 2.661 over that period. Partly because 4.5% was about as low apartment rates were going to go no matter how far down Treasuries went but also I think that lenders are getting more aggressive, especially in the multifamily sector.

Continue reading Multifamily Loan Rates Moderate Then Dip, Good For Apartment Building Investors.