The Strange Tale of the Seattle Apartment Building Investment Cycle and Maybe Yours Too.

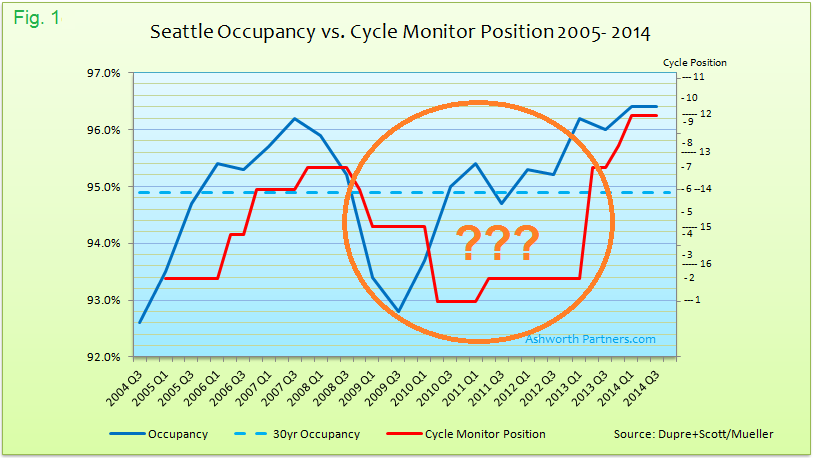

Back in 2012 it appeared that Seattle’s movement through the real estate cycle was stalling out. Not the actual market by any stretch of the imagination but instead where it was placed on the apartment market cycle charts in the Cycle Monitor report from Dividend Capital Research. These quarterly reports on the real estate market cycles for the five main Commercial Real Estate (CRE) sectors in more than fifty markets around the US were widely followed but something was wrong.

Why this up to date market data is vitally important to your investment success:

You can fix a property but not a market cycle. Knowing where a market is in its cycle is critical for investors seeking to buy low and sell high. If signals are a year or more behind, prime opportunities will be missed to Continue reading Widely Followed Apartment Market Cycle Research Misses Widely