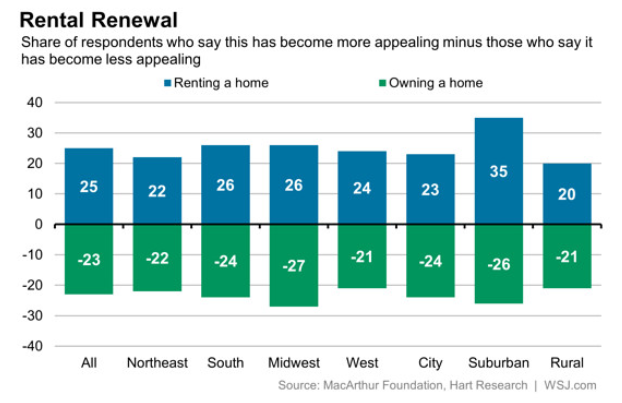

A MacArthur Foundation survey conducted by Hart Research Associates shows that 70% of Americans polled think that the housing crises isn’t over and 19% think the worst is yet to come, good for apartment building investment I believe. As reported by the Wall St. Journal in an article titled: Allure of Homeownership Slumps Amid Worries of Continued Crisis the worst is yet to come figure is unchanged from last year, which may reflect a segment of the population that has been deeply scarred by collapse of the lending and housing bubbles. The still in the crises figure is down from 77% a year ago but it is still a big number that’s having a positive effect on apartment demand:

Referencing the chart above, the article stated that 51% of those polled said renting was more appealing than in past decades which is definitely positive for apartment building investors. Note that while urban apartment demand and development has been getting a lot of action, 35% of suburbanites think renting is Continue reading 70% of Americans think housing crises continues, 51% say renting is more appealing #Multifamily