The Fiscal Times had a piece the other day reviving the good old rent vs. buy meme. The new angle was that Zillow has updated its method for comparing the costs of renting and the costs of buying and uses it to produce what it calls a ‘Breakeven Horizon.’ Besides sounding vaguely like the title of an old sci-fi movie, beyond the breakeven horizon is where buying a home makes more sense than renting and in theory the less time to the horizon, the more the market is tilted towards buying.

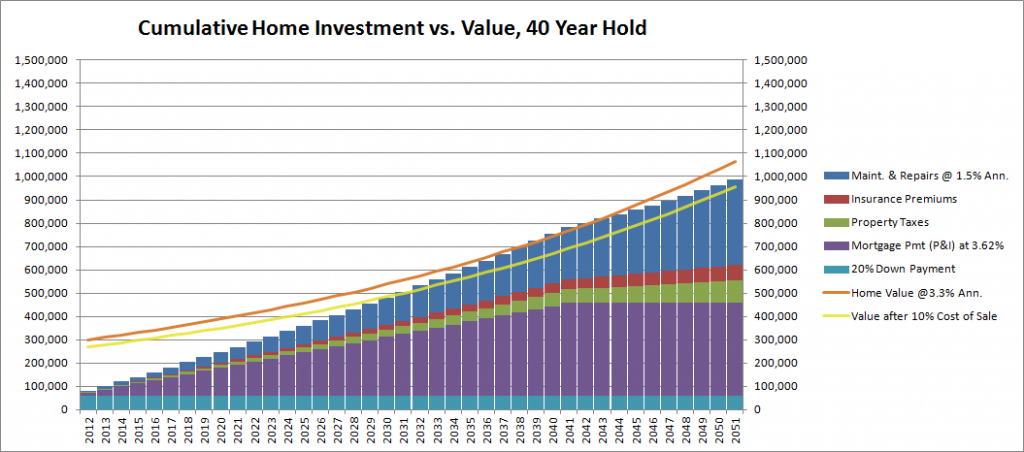

Now I have to admit I was intrigued with the thought that Zillow had re-examined their methodology because as I have written about earlier, their previous calculation ignored the real costs of maintenance, repairs and saving up for replacing big expensive things like the roof, the furnace and the driveway and that is a pretty big chunk of money over time. Industry figures for repairs and maintenance on single family housing run from one to three percent of the home value. Have a look at the chart* below to see how much a relatively modest 1.5% adds up to over time.

Surely I thought, Zillow had been convinced (by me maybe?) to add a reasonable amount for maintenance and repairs to their cost of ownership calculations so I searched and found their article describing the Event Breakeven Horizon update and from there was directed to this page where they describe the methodology in detail and there under the Net costs of buying a home heading I found this: “We assume owner’s insurance, maintenance and renovation costs to be 0.5% of the home value” [Emphasis mine]. Fifty basis points, that’s all? There is no way that a home can be maintained over the long run for that little. Let’s look at a list of maintenance and repair items for a home:

Exterior Maintenance & Repairs

- Roof & Gutters

- Drives & Walks

- Yard Care

- Yard Care Utilities

- Sprinkler System

- Caulk & Paint

- Doors & Windows

- Security System

- Lighting

- Pest Control

Interior Maintenance & Repairs

- Lighting & Plumbing Fixtures

- Appliances

- Door, Window & Cabinet Hardware

- Heating/Cooling System

- Counters

- Floorcovering

- Painting

- Cleaning

Replacement Reserves

- Roof & Gutters

- Heating/Cooling System

- Appliances

- Exterior Painting

- Drives & Walks

- Floorcovering

- Cabinets

- Counters

- Door, Window & Cabinet Hardware

- Windows

Yes everything your house is made of is wearing out, hopefully the foundation and framing will outlast you but everything else needs to be cared for and/or replaced regularly. Replacement reserves is a big item that homeowners tend to (and apparently Zillow absolutely) overlook but if you don’t want to pay $10-15,000 for a new roof with your 19-1/2% Visa card, setting aside money in advance costs a lot less in the long run. If you have a pool, a fountain, a fence, helicopter pad, whatever don’t forget to add the cost of maintaining those as well.

Some might claim that a lot of the maintenance can be done by the homeowner but it’s still a real cost and when compared to being a renter where all of it is included in the rent and done by the landlord or property manager… that is where Zillow seems to tilt the analysis in favor of owning. I’ll leave the speculation as to why a website that lists home values might be promoting homeownership to others.

The proof is in the pudding as they say because in the very same Net costs of buying a home section mentioned above Zillow spills the beans with this little admission: “For properties that are condominiums, we include an additional cost of condominium fees of 1.2% of home value per annum.” Now unless they think that condo boards are spending all of that money on party girls and recreational powders there must be something else they’re doing with it…. could it be maintenance, repairs and socking away something for the really big ones? Let’s say condo boards limit themselves to one Vegas trip a year and between that and admin, paperwork and overhead they burn through about .2% a year, that leaves 1% and when you add that to the fifty basis points Zillow assumes above you magically get to the 1.5% number I used in the chart. Hmmm. Now consider that there just might be some economies of scale in repairing and maintaining a condo complex because if so doesn’t it imply that single family home maintenance and repair costs should be higher than condo costs? And definitely home costs can not be just 29% of condo costs.

My Zillow Challenge

I will bring you all the property management business you can handle if you will guarantee all insurance, maintenance and renovation costs over .5% (50bp) of value per year. I will pay you 5% of collected rents plus .5% of value and you provide the management plus pay for all the insurance, repairs, maintenance, renovation including capex; let me know when I can start sending you properties.

If you have ever had to stay on budget for repairs and maintenance in real estate you know how hard that can be. If you’ve ever tried to stay under budget on anything I’m sure you appreciate the challenge involved so even 1-1/2% could really be tough to hit. My own experience with single family is that when you include renovation as Zillow does my expenses are more in the 5-7% range annually.

Here’s the real bottom line, straight from Zillow’s Buy versus Rent – Breakeven Analysis Methodology:

Despite the improvement, our price-to-rent ratio is still not very meaningful to a potential buyer who is considering buying a home versus renting, because it does not include all the costs incurred when purchasing and owning a home… the price-to-rent ratio does not inform potential buyers on how much it costs to own a home versus renting the same home at any given point in time. [Emphasis mine]

Like the theoretical event horizon beyond which no energy can escape from a black hole, apparently Zillow’s Breakeven Horizon is the theoretical point at which maintenance and repair costs can’t rise to their true level. I’m not knocking homeownership but if one is making a comparison between renting and owning one should start with the real costs involved.

*This chart is from an interactive Excel model I built to calculate the real costs of homeownership. To receive your free copy send us a message from our Contact Us Page with ‘Cost of Homeownership’ in the subject line.

It is very true that repair maintenance, insurance and other expenses are going up but by selling a property there is very small margin of profit. I hope in this financial year profit by selling a house will be increased. Now it is the good time for buying a house.

Leslie, I agree with you that now is a good time to buy a house if; you plan to stay in the same place for the next seven years, you are confident that your job is secure, if your credit is good, if you can put together the down payment and closing costs and moving expenses, if you can qualify for a mortgage. If not renting provides flexibility and the time to save up while repairing your credit, securing long-term employment and finding an area to put your roots down.