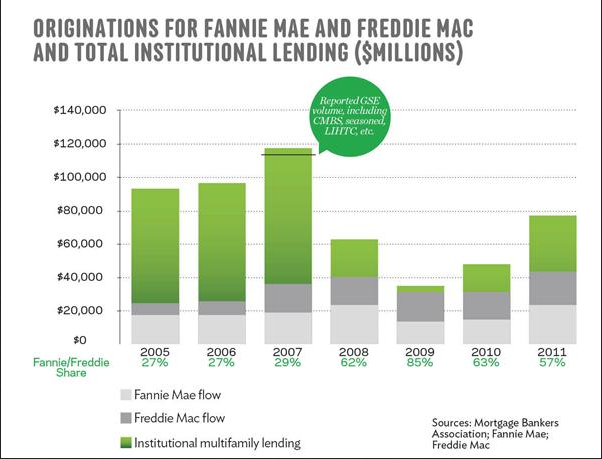

As reported by CoStar: “Given that the multifamily market’s reliance on the enterprises has moved to a more normal range, to move forward with the contract goal, we are setting a target of a 10% reduction in multifamily business new acquisitions from 2012 levels,” Edward DeMarco, acting director of the Federal Housing Finance Agency (FHFA) said. “We expect that this reduction will be achieved through some combination of increased pricing, more limited product offerings and tighter overall underwriting standards.”

While 10 percent doesn’t sound like much, Fannie Mae and Freddie Mac combined to finance about $62.8 billion in multifamily deals last year, meaning about $6 billion in liquidity will Continue reading FHFA’s DeMarco re-affirms cutting Fannie and Freddie apartment building loan volume.