As reported by CoStar: “Given that the multifamily market’s reliance on the enterprises has moved to a more normal range, to move forward with the contract goal, we are setting a target of a 10% reduction in multifamily business new acquisitions from 2012 levels,” Edward DeMarco, acting director of the Federal Housing Finance Agency (FHFA) said. “We expect that this reduction will be achieved through some combination of increased pricing, more limited product offerings and tighter overall underwriting standards.”

While 10 percent doesn’t sound like much, Fannie Mae and Freddie Mac combined to finance about $62.8 billion in multifamily deals last year, meaning about $6 billion in liquidity will have to come from other sources this year said MultifamilyExecutive.com (MFE).

And that’s just the short term goal, long term the he wants to put Fannie and Freddie out of business altogether. (See DeMarco pushes for five-year wind down of GSEs on HousingWire.com) While there is nothing carved in stone yet many in the apartment industry are concerned that the GSEs multifamily lending baby will get thrown out with the much larger and far more troublesome single family bathwater.

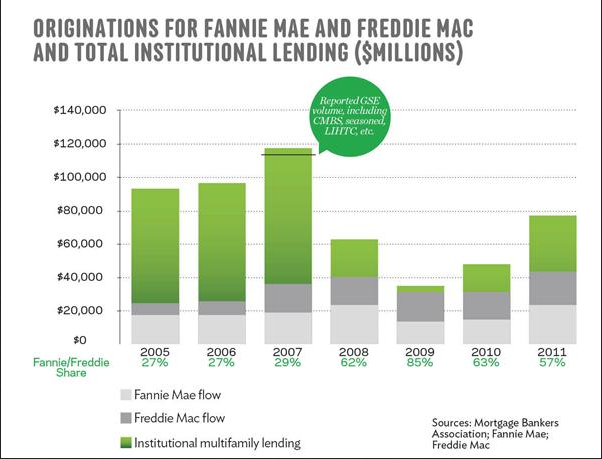

It is true that banks, insurance cos. and even CMBS lending to apartment building investors is picking up but my major concern is what happens when TBTF banks blow up the economy again? A quick look at the chart above shows that when the economy cratered in ’08 Fannie Mae and Freddie Mac apartment building lending was what kept the business going in those dark days. Since the TBTF banks’ wholly owned subsidiary, US Congress has proven unwilling to address the banks continuing use of highly leveraged derivatives trading and negligible capital ratios it’s just a matter of time before it all blows up again. With no Fannie or Freddie in place the apartment building industry might just dry up and blow away in the wind.

It’s ironic too that DeMarco is putting apartment lending on the block when that side of the business has been profitable and trouble free for Fannie and Freddie. According to the NMHC/NAA : “[T]he very successful multifamily programs of Fannie Mae and Freddie Mac were not part of the meltdown and have actually generated more than $10 billion in net profits to the government since conservatorship. And as CoStar noted: “The Fannie Mae and Freddie Mac multifamily programs, unlike those for single-family, use stringent underwriting that has resulted in a default rate of just 0.25%. Private-market sources of multifamily capital like CMBS, on the other hand, have a default rate of 15%…” [Emphasis mine]

Net-net I guess rates higher and underwriting tighter in the future. It does help also that we are starting to see more competitive lending from banks and insurance cos., even on smaller apartment building investments.

If we are discussing a world without any GSE lending, like Mr. DeMarco is proposing then I would suggest the government still remaining active in the financial market. If they will not directly act in the market they must at least remain a presence to foreseeing market stability. Perhaps by enacting stricter lending laws, or more thorough underwriting. The problem is that such actions will generally stall market efficiency and generally lead to slow growth, and deflate the market. That is why I believe that the 10% cutback is a good idea, but after seeing how the cutback effects the market the GSE’s should take a step back and evaluate their options after seeing the effects of large cuts. If the GSEs cut funding entirely how do you think the market would react, and who will ‘pick up the slack’?

I thoroughly enjoyed this post about the role GSE’s are currently playing in the market and where they are going to head in the future. Without Fannie Mae and Freddie Mac to support the entire multifamily market almost no financing would have been available to investors seeking capital. Your chart that you posted showing that in 2009 Fannie Mae and Freddie Mac were responsible for 85% of institutional lending was a helpful graphic to contextualize just how important the government enterprises were, and currently are, in the multifamily market. After the economic collapse in 2007 it was crucial and necessary for Fannie Mae and Freddie Mac to increase their market share and keep the market afloat. As you said in the post, other forms of financing are returning to the market. Banks, insurance companies and CMBS are all now growing and have capital to inject into the market place. A CMBS that was once dead is now beginning to grow and become a significant player in the financial market. What is also interesting is that these government entities were not only thrust into the forefront of a collapsing market but also still made sound and profitable investment decisions.

While the role Fannie and Freddie played was necessary I do not believe they should continue to be at the forefront of the market and be a majority contributor to the multifamily lending market. I also disagree with CoStar’s claim that Fannie and Freddie are in the normal range when they still represent at least half of all institutional lending. The 10% cut back in multifamily lending will most likely echo the recent changes the FHA instituted in the single-family market. Last April the FHA increased its upfront insurance premium from 1% to 1.75%; in addition the FHA also plans to further increase the annual insurance premium rate from 1.25% to 1.35% this coming April. GSE’s should target to represent somewhere between 30-40% of the institutional lending and should remain in the background for when the next housing bubble eventually burst. In this regard I agree with you that Mr. DeMarco should not halt making loans in the multifamily market, especially considering how profitable the investments have been. After 2007 Fannie Mae and Freddie Mac proved how vital they were to the financial market, and by eliminated the only institution with the ability to stabilize the market Mr. DeMarco is showing how little the FHA learnt from the latest financial crisis.

Mr. Isaksen, I appreciate the time you take running this blog and thank you for taking the time to read this response.

Best,

Jeff Shafran

Jeff, thanks for your thoughtful comments. Your idea about keeping the GSEs multifamily lending to between one third and less that one half the total market make sense on a macro level. We have a value add deal that we were intending to do a Fannie refi on towards the end of the year but now we’re exploring bank and conduit lenders as a backup plan. It’s the classical situation where my vitally needed program is someone else’s big fat pork barrel benefit. But we’re coming to the days when those hard choices have to be made and people will have to sacrifice. Unfortunately it seems like you can’t get elected promising to cut the programs that your voters like so we’re left with sequestration and unintended consequences.

I agree with you that GSE apartment lending must remain viable enough to pick up the slack in a downturn but it sounds like DeMarco is intent on shutting them down altogether over the next five years. How would you propose that the GSEs apartment lending function be handled?